The firm increases exposure across multiple ETFs as crypto equities attempt a rebound despite heavy market outflows.

ARK Invest Accelerates Crypto Accumulation Across Key Funds

ARK Invest ended the week with a broad series of purchases spanning Bitcoin ETFs, crypto infrastructure firms and digital asset equities. The investment firm added positions in Circle, Bullish, BitMine, Robinhood and several Bitcoin ETF products as markets attempted a modest recovery after weeks of selling pressure.

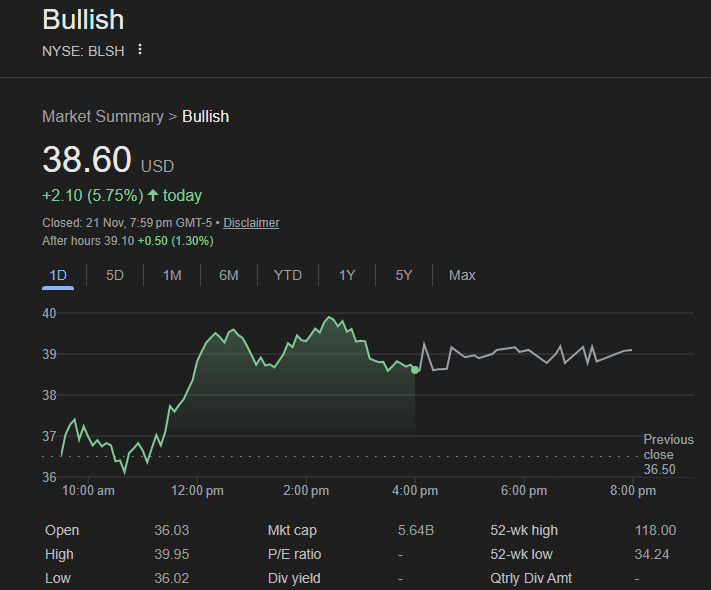

Trade disclosures show that Bullish received the largest inflows from ARK’s flagship funds, signaling renewed confidence in the company’s long-term prospects.

Introduction: Strategic Buying During Market Volatility

While the broader crypto sector remains under pressure—with Bitcoin ETF outflows nearing historic levels—ARK Invest continued its strategy of buying into weakness.

The firm accumulated exposure across its ARKK, ARKF and ARKW funds, underscoring a belief that the recent downturn represents an opportunity rather than a trend shift.

Analysts note that ARK’s moves align with its long-term conviction approach, in which significant declines are seen as favorable entry points.

Bullish, BitMine and Circle Among Top Targets

ARK’s combined purchases of Bullish reached roughly $2 million, following the stock’s 5.75% rise during the session.

The firm also boosted its position in BitMine, acquiring approximately $830,000 worth of shares. BitMine’s price remained steady near the $26 range despite recent volatility.

Smaller but notable additions included:

- 3,529 Circle shares, valued at around $250,000, as the stock surged more than 6%.

- About $200,000 in Robinhood, extending ARK’s growing stake in the trading platform.

ARK Increases Bitcoin ETF Exposure Despite Heavy Outflows

On the same day, ARK added nearly $600,000 in Bitcoin ETF exposure, led by purchases of the ARK 21Shares Bitcoin ETF (ARKB). ARKF and ARKW combined picked up more than 20,000 shares.

This buying came at a time when U.S. spot Bitcoin ETFs saw close to $1 billion in net outflows, their second-largest daily withdrawal to date. The month has recorded over $4 billion in total outflows as Bitcoin’s price has fallen nearly 30% from recent highs.

Analysts say the move reflects long-term conviction rather than short-term positioning, highlighting ARK’s willingness to accumulate during periods of market fear.

ARK Continues Its Broader Crypto Buying Spree

Throughout the week, ARK executed one of its most aggressive accumulation runs of the year.

On Thursday alone, the firm purchased:

- $10.1 million in Coinbase

- $9.9 million in BitMine

- $9 million in Circle

- $9.65 million in Bullish

- $16.8 million in Nvidia

- $6.8 million in Robinhood

Earlier in the week, the firm added $16.8 million in Bullish, $15 million in Circle and $7.6 million in BitMine across multiple ETFs.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.