Technical indicators reveal growing bearish pressure after recent declines

AAVE extended its downward trajectory , slipping roughly 4% to trade near $156, continuing a multi-week corrective trend that has unsettled leveraged traders. The decline reinforces weakening sentiment across decentralized lending assets, as market participants reassess risk appetite heading into the year’s final stretch.

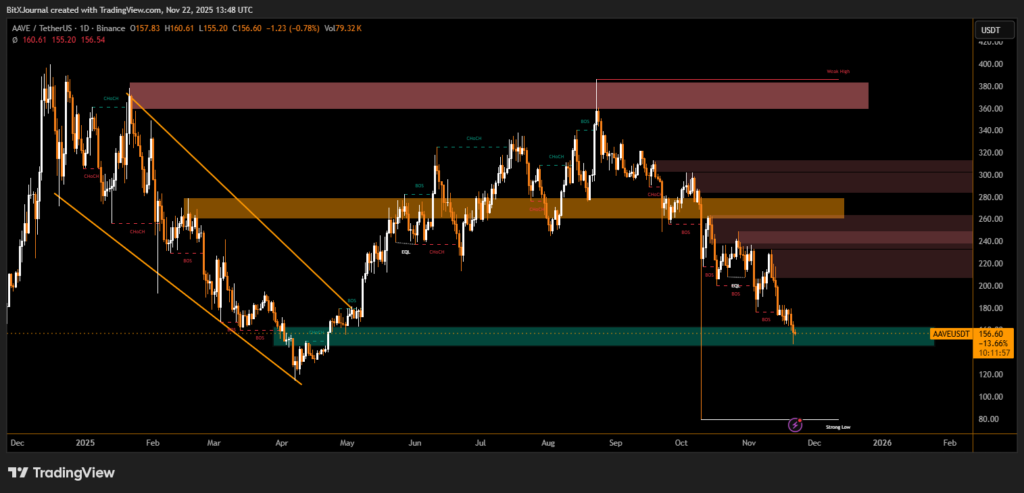

For technicians, the drop did not arrive unexpectedly. The daily chart shows the token breaking multiple short-term structures throughout November, signaling eroding bullish momentum. The latest move pushed AAVE back into a long-watched demand region between $150 and $140, an area that historically attracted strong accumulation. Analysts note that losing this level could expose liquidity pockets closer to $120.

Recent price action also reflects repeated rejections from a significant supply zone around $260 to $280, a level that capped multiple rallies throughout late summer. That failure contributed to the formation of consistent lower highs, a classic bearish continuation pattern. BitXJournal derivatives strategist noted, “The market respected resistance perfectly, which tells us institutional sellers are still in control. Until price reclaims the mid-$200s, upside remains speculative.”

Volume trends further support the pullback narrative. Trading activity has tapered rather than intensified on the way down, suggesting rotation rather than panic. Even so, several chart analysts warn that extended stagnation may increase volatility risk. “AAVE keeps printing breaks of structure without meaningful retracement,” said BitXJournal market research consultant. “That usually implies unfinished downside objectives.”

Still, not all observers are pessimistic. Some argue the token is approaching a historically significant level that previously sparked trend reversals. The current zone aligns with April’s recovery base, where long-term holders stepped in. “If buyers defend this region again and form a higher low, the market could attempt a relief rally,” BitXJournal technical analyst said.

Long-term fundamentals remain intact, supported by steady borrowing activity and continued protocol development. But traders emphasize timing and confirmation, especially amid uncertain macro conditions. The key question now is whether AAVE can stabilize above support or whether momentum will drive it toward deeper valuation discounts.

For now, market watchers are monitoring structural shifts, liquidity behavior and closing price reactions. The next few sessions may reveal whether this downturn represents consolidation— or the start of a more decisive trend extension.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.