The macro strategist argues that a lack of euphoric sentiment reduces the probability of a deep market crash despite recent volatility.

Despite Bitcoin’s sharp pullback from its October peak, macro analyst Lyn Alden believes the crypto market is not signaling the kind of extreme sentiment typically seen before major collapses. Speaking on a recent podcast, Alden said current conditions point to a lower likelihood of a deep capitulation event, even as some analysts warn of significant downside ahead.

Crypto Market Lacks “Euphoric Levels,” Reducing Crash Risk

Alden emphasized that the market has not reached euphoric conditions this cycle — a phase where excessive optimism and rapid inflows often precede steep crashes.

“We haven’t hit euphoric levels in this cycle; therefore, there is less reason to expect a major capitulation,” she said.

She also challenged the long-standing four-year-cycle narrative, noting that the current environment is influenced more by macroeconomic forces than Bitcoin’s programmed halving events. “The cycle could go on longer than people expect,” she added.

Market analyst Trevor Miles commented that “Alden’s view reflects broader trends — institutions are active, leverage is lower, and sentiment is cautious rather than overheated.”

Not Everyone Agrees on Market Outlook

Some experts, however, still anticipate a sizable correction. Sigma Capital’s Vineet Budki has warned of a potential 65% to 70% Bitcoin retracement in the coming two years, citing market fragility and freshly minted “weak hands.”

Alden countered that investors typically overestimate extremes. “It’s usually not as good as people expect, and it’s usually not as bad,” she explained.

Bitcoin Pullback Tests Investor Patience

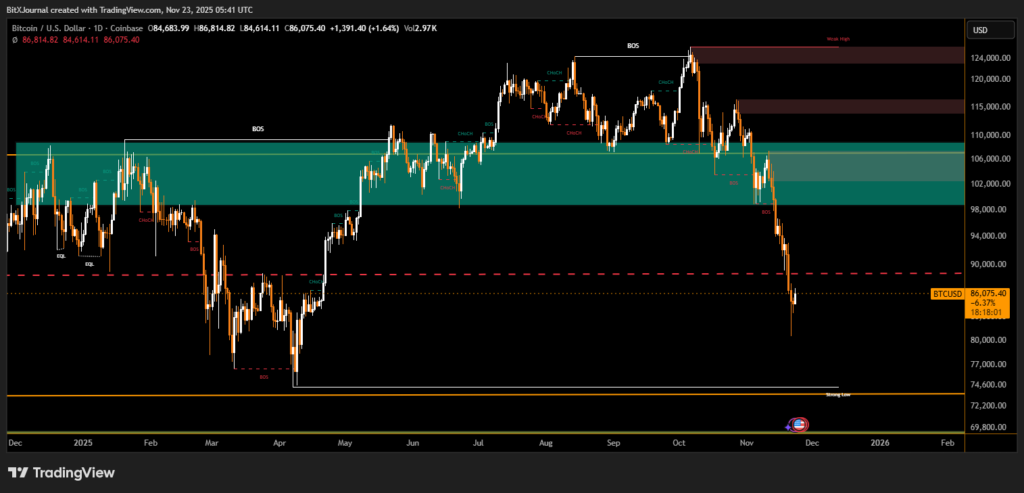

Bitcoin has slipped more than 22% over the past month, falling from its all-time high of $125,100 on Oct. 5 to lows near $80,700 before a slight rebound. Market sentiment softened as traders who expected year-end strength were caught off guard. Some high-profile predictions — including calls for a move toward $250,000 — remain far from current price action.

Alden cautioned against entitlement in market cycles. “No one is owed a bull market,” she said, underscoring the importance of long-term perspective.

New Highs on the Horizon?

Despite the turbulence, Alden maintains a constructive long-term view. She expects Bitcoin to reclaim $100,000 by 2026, with the potential to set fresh all-time highs that year or in 2027.

The broader takeaway: while volatility remains, the absence of speculative mania suggests the current downturn is unlikely to morph into a historic market capitulation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.