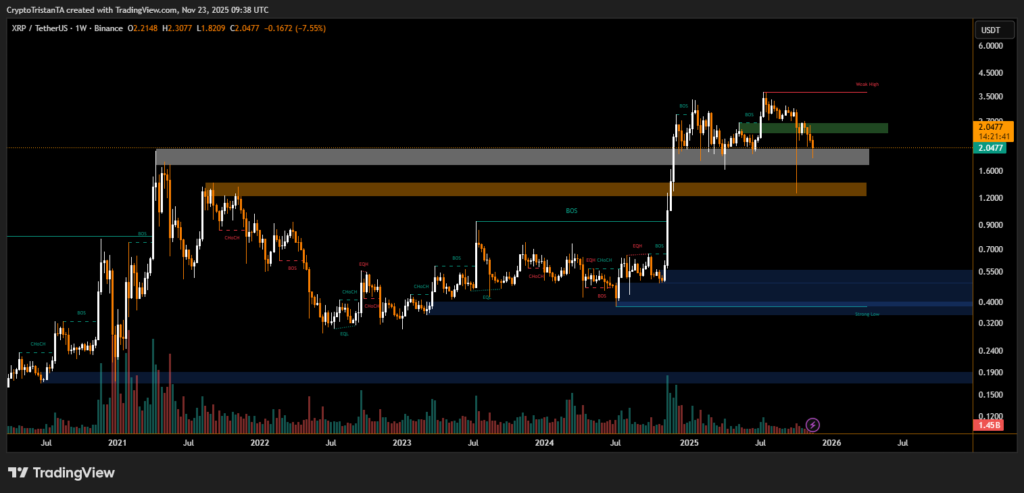

The weekly chart shows XRP slipping from recent highs and moving into a crucial structural zone that may determine its next major trend

XRP is trading near $2.04 after a sharp weekly decline, positioning the asset at a decisive point in its broader market structure. The long-term chart you provided highlights multiple Break of Structure (BOS) shifts, repeated CHoCH signals, and clearly defined supply and demand zones. This week’s movement raises questions about whether buyers can defend critical support or whether XRP may be preparing for a deeper retracement.

XRP Weekly Technical Outlook

The chart reveals that XRP rallied strongly into late 2025, pushing into a high-value supply zone just below $3.50, where a weak high remains untested. The rejection from this region has now pushed the price back into a broad gray mid-range zone, a historically contested area that has acted as both resistance and support across several years.

BitXJournal market analyst observing the structure noted, “XRP’s weekly chart shows a textbook reaction from higher-timeframe supply. The current decline reflects a loss of short-term demand, and traders should watch how price behaves around the mid-range liquidity pocket.”

Repeated Change of Character patterns across the upper zone confirm fading bullish strength, while the BOS levels from earlier in 2024 still support the argument that XRP remains macro-bullish—provided it holds above its major demand blocks.

Critical Support Zones in Focus

A large, multi-year demand region between $0.55 and $0.90 remains XRP’s most important structural floor. This zone has consistently generated long-term reversals and carries the label strong low on the chart.

BitXJournal analyst explained, “If XRP re-enters the deep blue accumulation band, the market could see significant volatility. A break below it would shift the macro structure entirely.”

The defense of this strong low could define whether XRP continues its multi-year recovery or transitions back into a bearish cycle.

The mid-range rejection highlights that bulls are losing control, making the next few weekly candles critical.

XRP’s weekly structure points to caution as momentum cools and price approaches its central support zones. While long-term bullish arguments remain intact, the current retracement signals that the market is reevaluating its next direction. Traders will be watching closely to see whether buyers defend the mid-range or allow XRP to slide into deeper demand levels that have historically provided powerful reversals.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.