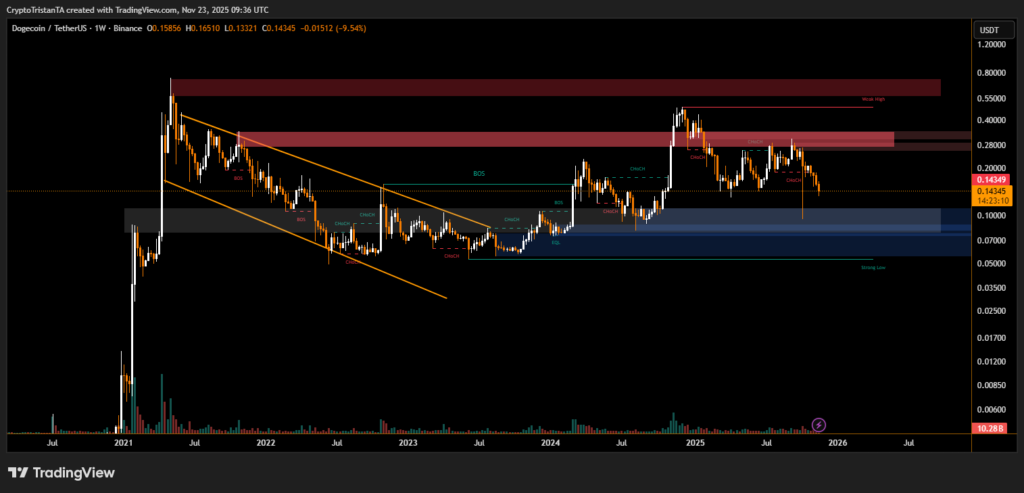

Long-term charts show Dogecoin testing a critical demand zone, raising questions about whether buyers will defend historic support levels

Dogecoin’s weekly chart shows a clear shift in momentum as the asset trades near $0.143 after a sharp multi-week decline. The broader market has entered a corrective phase, and the latest technical structure suggests that the meme-coin may be approaching an important inflection point. While long-term support remains intact, the price is now moving closer to a zone where previous recoveries have historically begun.

Dogecoin Weekly Technical Outlook

The chart reveals a prolonged downtrend beginning after the 2021 peak, followed by a breakout in 2024 that briefly restored bullish momentum. However, Dogecoin has since slipped from the upper supply zone between $0.28 and $0.40, giving back a substantial portion of recent gains.

BitXJournal Analysts note that repeated Change of Character (CHoCH) signals on the weekly timeframe show weakening demand. One market strategist explained, “Dogecoin has lost short-term structure, and unless buyers step in near the major demand block, the asset could revisit deeper support.”

The next significant zone lies between $0.07 and $0.10, an area highlighted on the chart as a broad accumulation region. Historically, this band has sparked strong rebounds. The chart also marks a strong low, indicating an area where long-term buyers previously defended price with conviction.

Key Support Zones Driving This Week’s Outlook

One of the most important levels in the current market structure is the dark blue demand region. If price revisits this area, technicians expect increased volatility. As BitXJournal analyst commented, “The market is watching whether Dogecoin can maintain its weekly structure. A sustained break below the mid-range could open the door to a deeper retracement.”

The market’s ability to hold above the strong low may define Dogecoin’s multi-month trajectory.

The breakdown from the upper supply zones confirms that sellers still control the broader trend.

Dogecoin remains at a critical stage on the weekly chart. While the macro trend shows periods of strength, the current pullback places attention on whether buyers will defend long-standing support. The coming weeks will determine if the asset stabilizes for another recovery phase or continues its descent toward historical demand levels.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.