Unexpected shutdown of Jack Mallers’ accounts renews scrutiny over alleged regulatory pressure on crypto-linked businesses

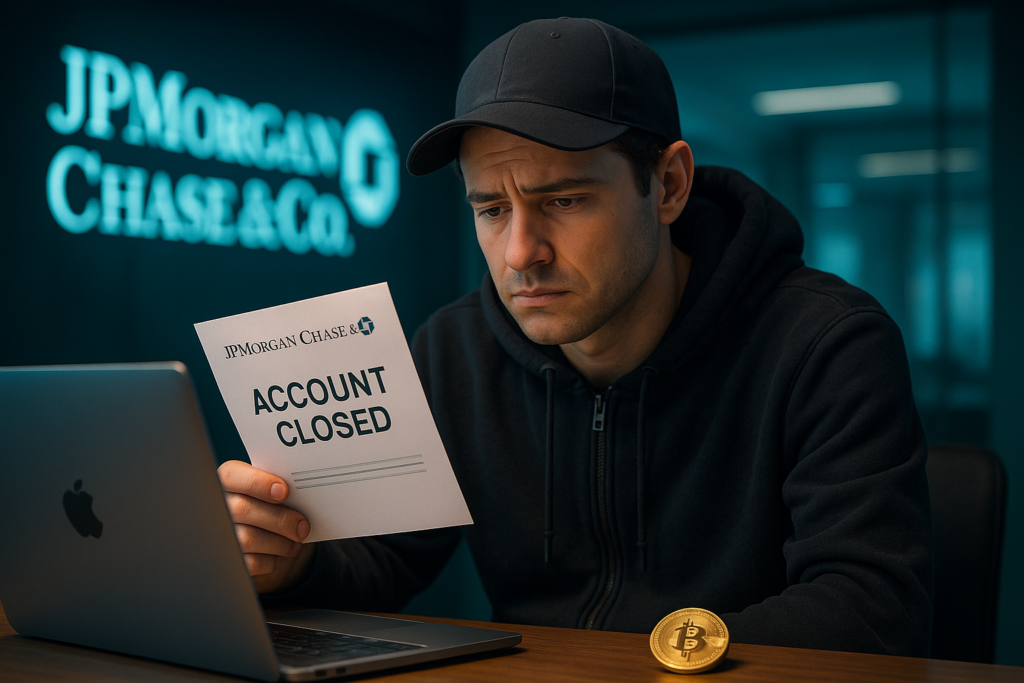

The sudden closure of Strike CEO Jack Mallers’ personal accounts at JPMorgan Chase has intensified industry-wide concerns about crypto debanking in the United States. Mallers revealed that his accounts were terminated without warning and without a clear explanation — raising new questions about whether informal regulatory pressure on banks is still influencing decisions behind the scenes.

Crypto Banking Access Under Pressure

Mallers disclosed on X that JPMorgan had shut down his accounts last month, describing the move as “bizarre,” especially considering his family’s long-standing relationship with the bank.

When he attempted to understand the reason, he said the bank’s response was simply: “We aren’t allowed to tell you.”

A letter he shared indicated the bank found “concerning activity” on his accounts and warned that opening future accounts may not be possible. Though the bank did not specify the nature of the flagged activity, the lack of transparency has fueled speculation across the crypto sector.

Industry analysts say the incident highlights a recurring risk: financial institutions still view crypto-focused executives and companies as compliance-heavy clients.

“banks continue to treat crypto exposure as a regulatory hazard, even if no formal directive is in place.”

Concerns Over “Operation Chokepoint 2.0” Resurface

The post quickly reignited debate over “Operation Chokepoint 2.0,” an alleged coordinated effort by regulators to pressure banks into distancing themselves from crypto businesses.

Despite recent political changes, online commentators argue the practice may still be influencing certain banking decisions.

A policy researcher commented that “the perception of regulatory risk alone can push banks to exit relationships with crypto leaders, whether or not government pressure exists.”

The debate intensified after a previous executive order aimed at penalizing firms that debank crypto-related businesses. Still, Mallers’ experience suggests uncertainty remains around how banks interpret their compliance obligations.

Crypto Leaders Respond

Tether CEO Paolo Ardoino publicly responded to Mallers, suggesting the incident might ultimately strengthen Bitcoin’s resilience. Ardoino emphasized that attempts to suppress crypto adoption will fail over time, pointing to the technology’s enduring decentralization and global support.

Mallers’ account termination highlights a persistent challenge for the digital asset sector: reliable banking access.

As regulatory interpretations evolve, the industry continues to call for clear guidelines to prevent what many perceive as informal debanking practices targeting crypto innovators.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.