BTC Technical Outlook Strengthens With Fresh Break of Structure

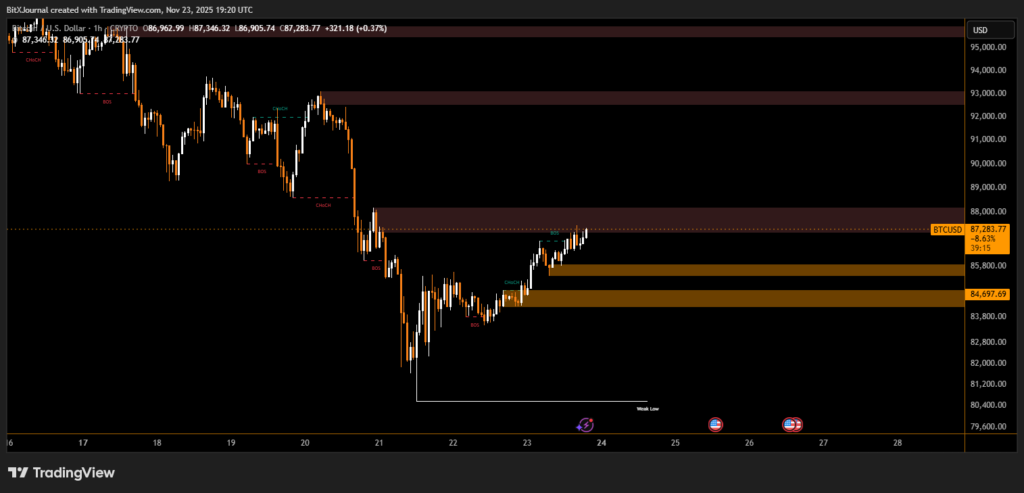

Bitcoin pushed above the $87,000 level late on Saturday, showing a strong recovery after a week of volatile trading. The move comes as short-term charts reveal a decisive shift in market structure, with buyers stepping in aggressively from well-defined demand zones. Traders tracking the one-hour chart note a clean Break of Structure (BOS) that has shifted momentum back toward the upside.

A Renewed Upswing After Deep Liquidity Sweep

Bitcoin’s rebound follows a sharp decline earlier in the week that swept liquidity beneath the weak low near $81,000, a level many technical analysts had marked as a potential springboard for a bullish reaction. That expectation played out as price launched upward from the $84,600–$85,800 demand region, a zone highlighted repeatedly on lower-timeframe analysis.

BitXJournal Market technicians say the reaction from that area was significant. One analyst noted that the rebound “confirmed that buyers were waiting below, and the fast reclaim reinforced the shift in intraday direction.”

The surge above $87,000 is now testing a major supply band that extends toward $88,200, an area that previously triggered heavy selling pressure.

Critical Resistance Ahead as Bitcoin Approaches Key Supply

Charts show a prominent supply block overhead, and BTC is currently pressing into the lower boundary of that region. The market has yet to show evidence of displacement through the zone, but the continuation of higher lows suggests participants are anticipating another upward leg.

“If Bitcoin can maintain structure and close decisively above the mid-$88k band, the door opens toward the next liquidity pocket above $90k,” said BitXJournal market strategist watching the breakout potential.

What Traders Are Watching Next

- Support: $85,800 and $84,600

- Immediate resistance: $88,000–$88,500

- Bias: Bullish while price holds above demand

The structure remains constructive as long as Bitcoin stays above recent reclaimed levels. The market is entering an important weekend zone where volatility tends to increase, and traders are watching whether the current upward push will evolve into a full trend continuation or meet resistance strong enough to stall momentum.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.