Heavy Put Positioning at $80K Raises Volatility Risks Ahead of Monthly Expiry

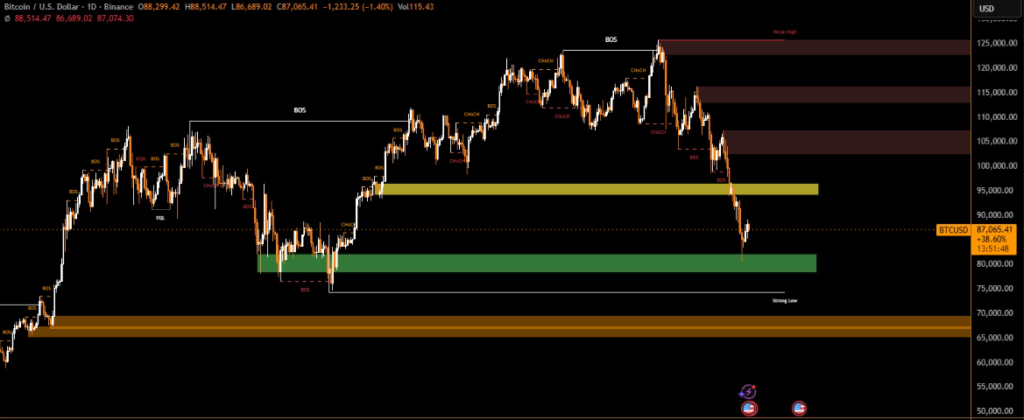

Bitcoin is approaching one of its largest monthly options expiries of the year, with $13.3 billion in notional open interest set to expire on Friday. The market enters the expiry week under pressure after a sharp correction drove BTC down to $81,000 before stabilizing near $87,000.

Massive Options Expiry Highlights Market Stress

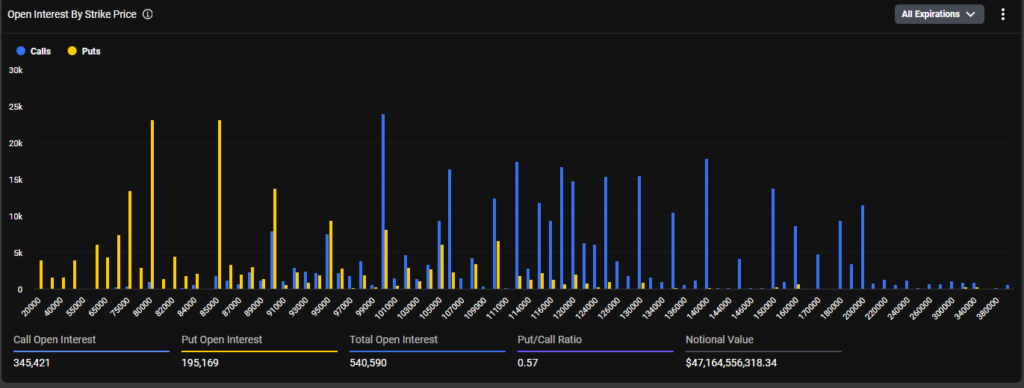

Data shows 153,778 BTC in total open interest is due to expire, consisting of 92,692 BTC in calls and 61,086 BTC in puts. The put-call ratio of 0.66 indicates call options still dominate, but demand for downside protection has grown significantly.

The most striking element is the max pain level at $102,000—the price where option sellers lose the least.

Bitcoin is trading nearly 17% below that threshold, highlighting severe dislocation between spot and derivatives markets.

According to options analysts, this setup raises the likelihood of heightened volatility. “When max pain sits far above spot, market makers tend to adjust hedges aggressively, and that can amplify price swings,” .

Heavy Concentration at the $80K Strike

The largest cluster of put open interest sits at $80,000, a level that now acts as both a psychological and mechanical pressure point. Current data shows only 26% of all contracts are in the money, equal to roughly $3.4 billion, while 74%—over $10 billion—remain out of the money.

“This is one of the most lopsided expiries we’ve seen in months. A huge portion of positions are sitting far from profitable levels, which suggests traders were preparing for bigger moves than the market delivered,”According to BitXJournal market analysts.

Fragile Sentiment Ahead of Expiry

Despite the recent price recovery, sentiment remains fragile.

The dominance of out-of-the-money positions indicates traders expect continued instability into Friday.

Higher-strike call positions—especially those above $120,000—are now far from being exercised, showing that earlier bullish projections have evaporated during the broader market correction.

With large defensive put positions stacked at key strikes, analysts warn that BTC may experience sharp intraday swings as expiry approaches.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.