Despite historically strong performance in October and November, Bitcoin is slipping below seasonal norms, prompting debate over whether renewed buying or a deeper accumulation phase lies ahead.

Bitcoin is on track to close November in negative territory, marking a rare break from its historically strong seasonal pattern. Analysts at Bitfinex say the downturn may not last long, noting early signs that large holders could be preparing to re-enter the market. With BTC trading significantly below its monthly open, the focus now turns to whether demand will recover or if the market is heading toward a prolonged accumulation period.

Bitcoin Faces Unusual Seasonal Weakness

November has traditionally been Bitcoin’s strongest month, delivering an average return of 40.82%, according to CoinGlass. But instead of repeating that trend, BTC has slipped 20.60% below its monthly starting price. October also disappointed, closing down 3.69%, defying its typical gains of nearly 20%.

Bitfinex analysts said that historic seasonality metrics have failed to hold up this quarter, pointing to shifting trader behavior and broader market uncertainty. At the time of writing, Bitcoin trades near $87,305, well below this year’s highs.

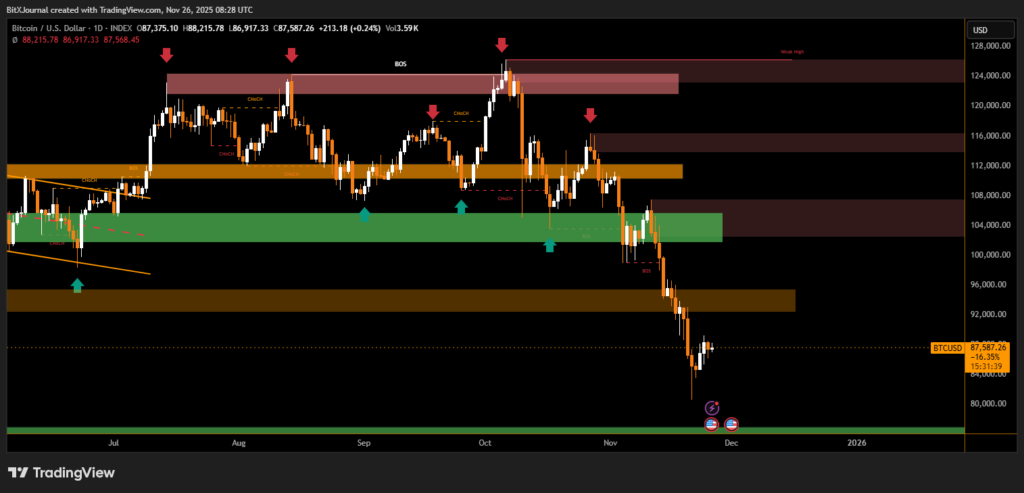

BitXJournal market analyst commented that the sharp shift in sentiment “caught traders off guard,” as many expected seasonal strength to support prices after October’s dip.

Whale Activity Shows Early Signs of Recovery

Although sentiment has been weak, some indicators suggest potential demand may be forming again. Santiment reported that wallets holding at least 100 BTC increased by 0.47% since Nov. 11—an addition of 91 wallets.

This month also marks only the third time since early 2024 that Bitcoin dipped below the lower band of the short-term holders’ cost-basis model. Short-term holders, defined as those holding BTC for less than 155 days, currently have an average realized price of $86,787.

Capitulation Continues Among High-Price Buyers

Bitfinex analysts attribute the latest decline to excessive buying around the $106,000–$118,000 levels earlier this year. Many of those buyers, they say, are now “capitulating at a loss”, creating added pressure on the market.

Even if seasonality remains unreliable this year, December traditionally posts modest gains, averaging 4.75% since 2013. While uncertainty persists, rising whale activity and oversold conditions hint that demand could return sooner rather than later.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.