Institutional Testing on Stellar Sparks Renewed Interest as Price Rebounds From Multi-Month Lows

The price of Stellar’s XLM token climbed more than 3% to $0.25, buoyed by news that a major U.S. banking institution has selected the Stellar network to test a programmable stablecoin pilot program. The development arrives at a time when XLM has been attempting to stabilize after weeks of downward pressure, with technical indicators showing early signs of a potential recovery.

Institutional Testing Lifts Market Sentiment

Stellar continues to strengthen its role in bank-grade digital asset infrastructure, with banks increasingly exploring tokenized deposits, stablecoins, and programmable payments. According to sources familiar with the pilot, the unnamed bank is testing a permissioned stablecoin framework using Stellar’s low-cost, high-throughput rails.

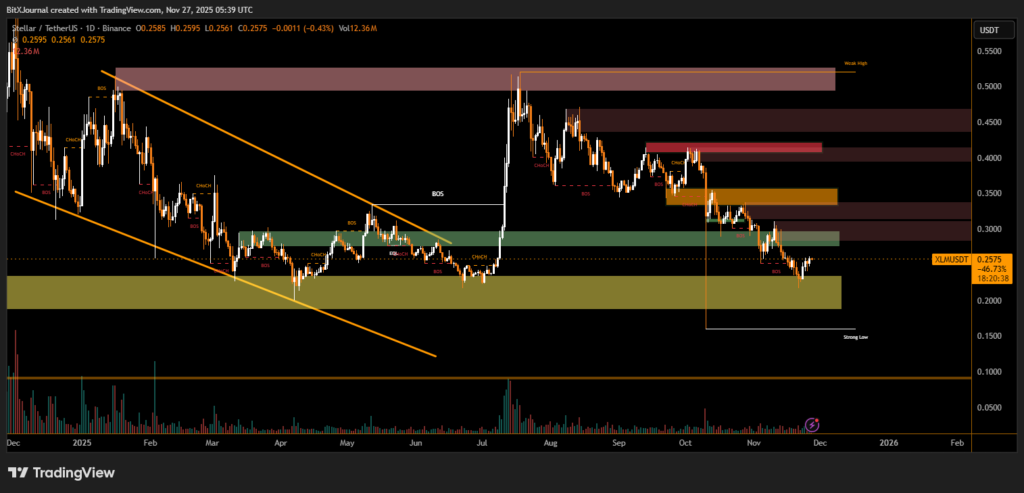

The market shows XLM rebounding from a major liquidity block, pushing higher toward local resistance levels around $0.28–$0.30. Multiple BOS (Break of Structure) signals and CHoCH (Change of Character) markers indicate early attempts at trend reversal.

BitXJournal market analyst noted that “XLM is showing attempts to reclaim mid-range structure after defending a critical weekly low. The bounce aligns with improving sentiment fueled by institutional testing.”

The market also features:

- A strong low, formed after repeated downside tests

- A clearly defined weak high overhead

- Multiple supply zones at $0.30, $0.35, and $0.45

- A large higher-timeframe accumulation range now re-tested

The analyst added that “clearing the $0.29 mark would open the path toward deeper liquidity pockets above $0.32–$0.35” — levels often targeted in bullish recovery phases.

Institutional Adoption Drives Utility Narrative

Industry experts emphasize that banks are increasingly evaluating blockchain networks capable of programmable payments and stablecoin issuance, and Stellar remains one of the networks tailored for institutional settlement.

BitXJournal digital asset researcher said, “Stellar’s advantage is its design for cross-border payments and asset tokenization. A successful U.S. banking pilot reinforces that narrative, especially at a time when financial institutions seek compliant on-chain solutions.”

BitXJournal Market observers believe the pilot could eventually lead to broader integrations involving:

- Tokenized bank deposits

- Interbank settlement trials

- Programmable remittance flows

- Enterprise-grade digital asset rails

XLM’s reaction to institutional news reflects the market’s sensitivity to real-world adoption. Traders will closely monitor whether price action can sustain above the $0.25 psychological level and challenge the immediate $0.28–$0.30 resistance bands.

If bullish momentum continues, analysts say a move toward the $0.35 supply zone becomes increasingly plausible.

For now, the combination of technical stabilization and institutional experimentation provides a constructive backdrop for Stellar in the final weeks of the year.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.