CEO and COO exit amid political pressure and regulatory questions surrounding the firm’s role in World Liberty Financial

Crypto treasury firm ALT5 Sigma, which holds large amounts of the Trump-linked World Liberty Financial (WLFI) token, has initiated a major leadership shakeup as U.S. lawmakers intensify scrutiny of the project. The restructuring — disclosed through a recent SEC filing — comes at a time when Trump-associated crypto ventures face questions over governance, transparency and national security risks.

ALT5 Sigma Removes CEO and COO During Governance Shakeup

According to the filing, ALT5 Sigma replaced CEO Jonathan Hugh and severed ties with COO Ron Pitters in November. The company said the departures were “without cause.”

Board member and company president Tony Isaac has stepped in as acting CEO while ALT5 Sigma negotiates the final terms of Hugh’s exit.

The leadership overhaul follows months of scrutiny surrounding the firm’s WLFI-focused crypto treasury strategy.

ALT5 Sigma has committed $1.5 billion toward acquiring WLFI tokens — a project tied closely to the Trump family, with Eric Trump serving on its board. That connection has placed the company at the center of a growing political controversy.

Political Scrutiny Intensifies Over WLFI’s Governance

Congressional Democrats have argued that President Trump’s family involvement in WLFI creates potential conflicts of interest, especially with the firm raising large sums to support a token directly linked to his political orbit.

In a November letter, lawmakers urged federal officials to investigate allegations that WLFI may have sold tokens to sanctioned entities in Russia and North Korea.

Lawmakers warn that Trump-linked crypto ventures could pose national security risks by enabling foreign access or political influence.

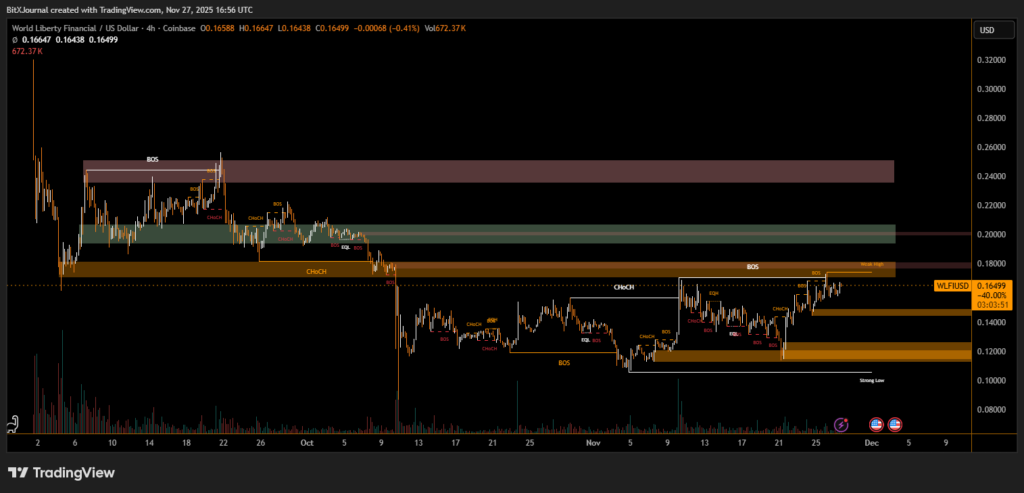

The WLFI token has also faced a downturn, reflecting growing market skepticism as investigations and political criticism mount.

ALT5 Responds to Rumors but Faces Ongoing Pressure

In August, speculation surfaced that ALT5 Sigma shareholder Jon Isaac was under SEC investigation for earnings manipulation — claims the company strongly denied. It clarified that Isaac had no executive role, saying it had “no knowledge of any current investigation.”

Eric Trump later reduced his position to board observer status to comply with Nasdaq’s governance rules, further signaling the heightened regulatory environment surrounding the project.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.