A sudden reversal despite rising demand for Solana staking products

Asset manager CoinShares has officially withdrawn its SEC filing for a staked Solana (SOL) exchange-traded fund (ETF), according to a recent regulatory disclosure. The move surprised analysts who expected more Solana-focused ETFs to go live in 2025 as investor demand for yield-bearing staking products continues to grow.

Why CoinShares Pulled the Application

Proposed structuring deal was never completed

The SEC filing revealed that the transaction underlying the ETF was never finalized, leading CoinShares to withdraw voluntarily. The document stated:

“The Registration Statement sought to register shares to be issued in connection with a transaction that was ultimately not effectuated. No shares were sold, or will be sold…”

This means the ETF never advanced beyond planning — no shares were issued, purchased, or distributed.

Despite withdrawal, other Solana ETFs continue to gain traction

The U.S. market already saw the debut of the first staked Solana ETF by REX-Osprey in June, followed by Bitwise launching its own staked SOL ETF in October. Bitwise’s product had an impressive start, recording $223 million in assets on day one, roughly half of what REX-Osprey accumulated in several months.

These ETFs allow investors to earn 5–7% staking rewards, creating strong appeal during market volatility.

$369M flowed into SOL ETFs in November

While Bitcoin and Ethereum ETFs saw heavy outflows through October and November, Solana ETFs attracted over $369 million, breaking multi-day inflow streaks even during market downturns.

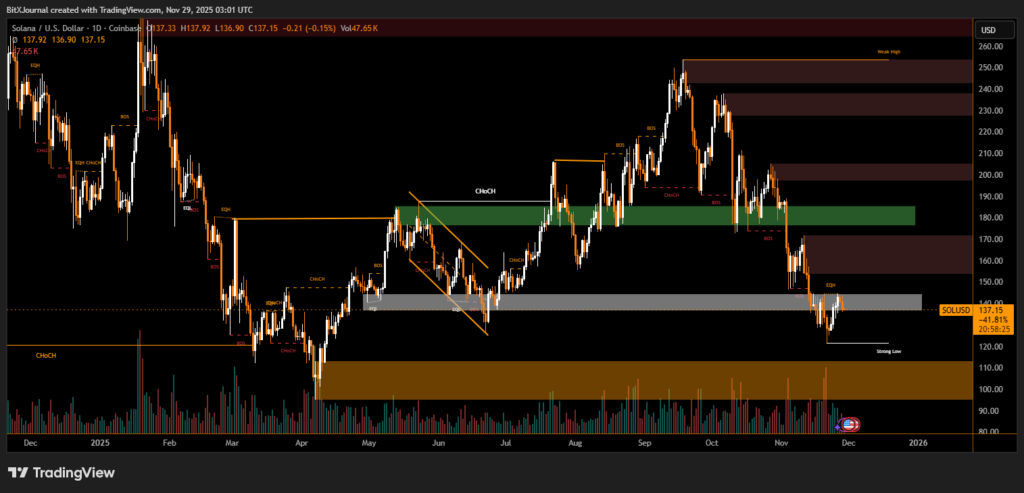

However, despite strong ETF demand, SOL’s price has failed to keep up:

- SOL peaked above $250 in September

- Fell to around $120 in November, a five-month low

- Down about 60% from its January 2025 all-time high of $295

Analysts who earlier predicted $400 SOL based on ETF momentum have revised targets downward, with many now believing reclaiming $150 will be difficult.

SOL’s explosive rally in January was largely driven by the viral launch of the Official Trump memecoin, which triggered a memecoin boom on Solana. As that hype faded, SOL struggled to maintain its elevated levels despite ETF inflows.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.