HBAR Technical Outlook After Post-Holiday Market Uptick

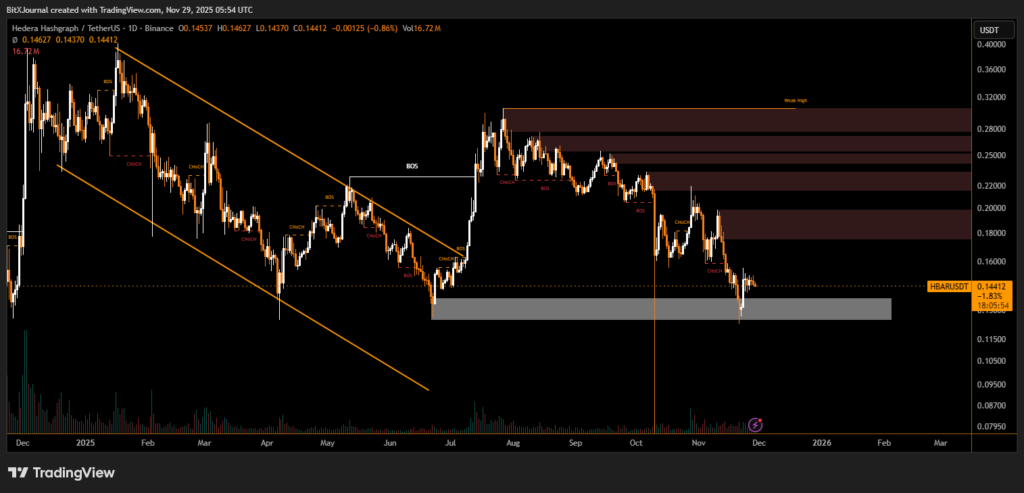

Hedera Hashgraph’s native token, HBAR, posted a modest rebound of about 2.5%, aligning with the broader crypto market’s post-Thanksgiving lift. While sentiment shows early signs of stabilization, the price chart reveals a complex structure defined by supply zones, liquidity sweeps, and repeated momentum shifts. Current technical positioning suggests that traders are watching closely for confirmation of a larger trend reversal.

HBAR Market Structure and Key Technical Levels

Recent price action shows HBAR reacting strongly from a well-defined demand zone around the $0.115 – $0.125 region. Market indicates that this area has repeatedly acted as a cushion during prior downswings. A sharp wick into this zone earlier this week signaled renewed buyer interest, marking a short-term market reaction that stopped further downside pressure.

Above current levels, the market highlights multiple stacked supply zones between $0.18 and $0.30. These zones have consistently capped bullish momentum since late summer, forming a layered region of overhead resistance. Each attempt to break these barriers has resulted in a Break of Structure (BOS) to the downside, reinforcing the broader corrective trend.

The mid-term trend remains sensitive after several Change of Character (CHoCH) signals appeared during the past two months, reflecting hesitation among traders. These signals show alternating control between buyers and sellers, creating a choppy environment. However, the recent bounce suggests that bulls are attempting to reclaim short-timeframe structure.

HBAR’s ability to hold above the current demand block is crucial. A sustained move above $0.155 – $0.160 could open the path toward revisiting the lower supply band near $0.18. Conversely, loss of the demand zone may re-expose the token to deeper corrective pressure.

The overall structure indicates that institutional flows and derivatives positioning may continue influencing direction. As the broader market stabilizes, HBAR traders are watching for a confirmed shift that would signal the start of a more durable recovery.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.