DOGE Holds Above Mid-Range Demand While Momentum Remains Fragile

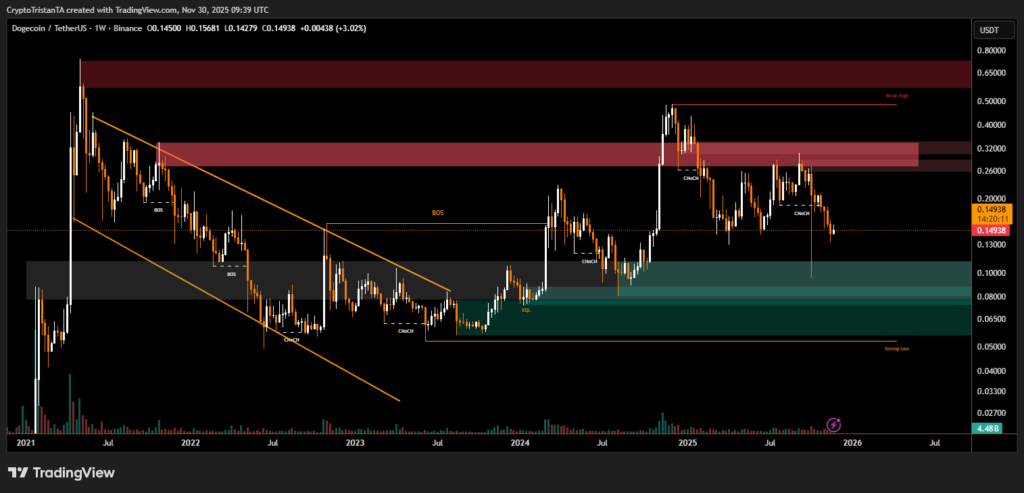

Dogecoin’s on weekly continues to show a carefully balanced structure as the market trades between long-established supply zones and deeply tested demand regions. Despite recent volatility, the broader trend remains shaped by repeated liquidity sweeps, break-of-structure signals, and critical demand ranges that have supported price for more than a year.

Dogecoin Price Analysis and Market Structure

DOGE remains in a consolidation phase after failing to break through the major supply band between $0.26 and $0.32, a zone that has rejected several attempts to reclaim higher ground. Above this region sits a broader supply block reaching toward $0.55 to $0.75, where a weak high suggests liquidity may one day be targeted but remains out of reach in the current cycle.

Should the market fail to sustain this support, the market identifies a deeper demand range around $0.06 to $0.08, anchored by a strong low formed in earlier accumulation phases. This lower region would likely act as a major liquidity magnet if selling pressure intensifies.

DOGE’s weekly structure remains neutral-to-bearish until buyers regain momentum above the first supply layer. A decisive weekly close over the $0.20–$0.26 region would significantly strengthen bullish continuation potential.

For now, Dogecoin trades within a well-defined range, absorbing liquidity as the market waits for the next decisive breakout or breakdown.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.