Despite the rise of bitcoin ETFs, gold remains the preferred asset for central banks and institutional allocators

Gold has taken a decisive lead over bitcoin in 2025, not only in price performance but also in global investor confidence. While bitcoin was expected to rally strongly following the launch of spot ETFs, its decline alongside tightening liquidity has highlighted a deeper issue: gold still holds the trust, infrastructure, and utility that major institutions rely on.

Gold’s Institutional Advantage in 2025

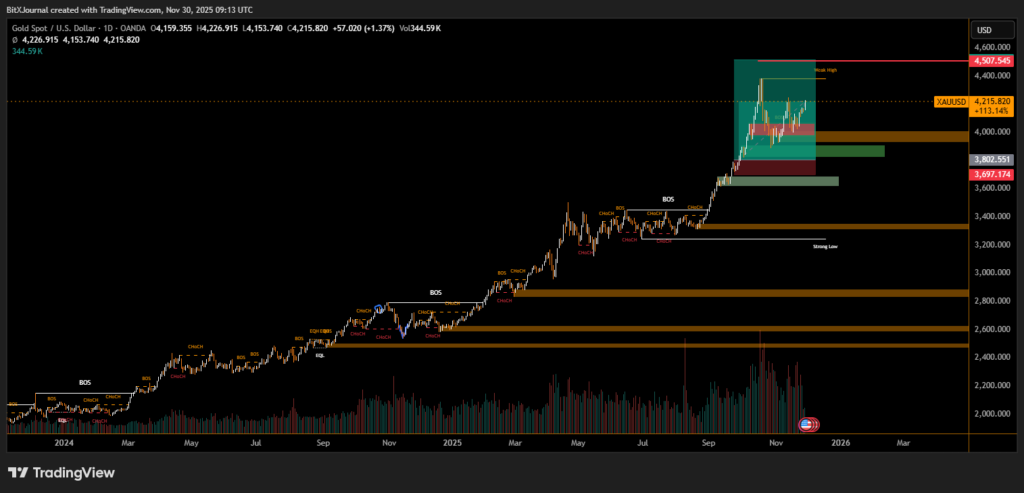

Since early 2024, bitcoin has fallen around 12%, while gold has surged by more than 58%. This divergence reflects structural realities. Gold benefits from centuries of trust, established settlement networks, and active use in global trade. Central banks, sovereign wealth funds, and asset allocators already operate within gold-based systems, making it a natural fit for reserves.

Bitcoin, despite its technological strengths, remains outside these channels. Large institutions have not begun integrating bitcoin into existing trade or settlement frameworks, limiting its adoption at the reserve level. Gold, on the other hand, continues to play a direct role in physical trade — particularly among BRICS nations, where gold is increasingly used to settle energy transactions.

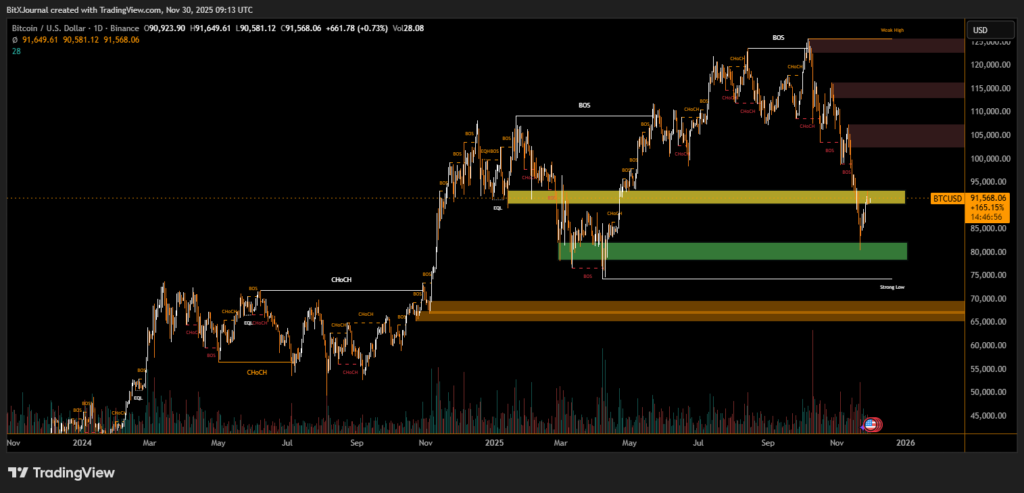

Bitcoin’s Decline Driven by Liquidity, Not Confidence

Bitcoin’s steep drop since July is tied to a global liquidity squeeze. U.S. fiscal delays, including slowed Treasury spending after the federal shutdown, reduced dollar flows across markets.

Bitcoin, being highly sensitive to liquidity shifts due to its leverage dynamics—especially in Asia—declined more sharply than traditional assets.

Gold, by contrast, climbed steadily past $4,100 per ounce, reinforced by demand from central banks and long-term allocators.

A Longer Path for Bitcoin’s Institutional Adoption

Although liquidity may return as U.S. fiscal activity resumes, bitcoin still faces a gradual road toward becoming a reserve asset. Institutions allocate based on mandates, not speculation — and gold currently fits those mandates in ways bitcoin does not.

While bitcoin may eventually gain traction as fiat confidence erodes in emerging economies, the asset is still maturing. The comparison between the two often oversimplifies reality: institutions are not choosing between gold and bitcoin — they are choosing what aligns with their operational and regulatory systems.

The 2025 divergence underscores a simple truth: gold’s established role in global finance continues to outweigh bitcoin’s potential. Bitcoin may still grow into a reserve asset, but trust, infrastructure, and trade utility remain firmly in gold’s favor — at least for now.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.