Technical pressure builds after liquidity sweep and structure shift signal deeper market weakness

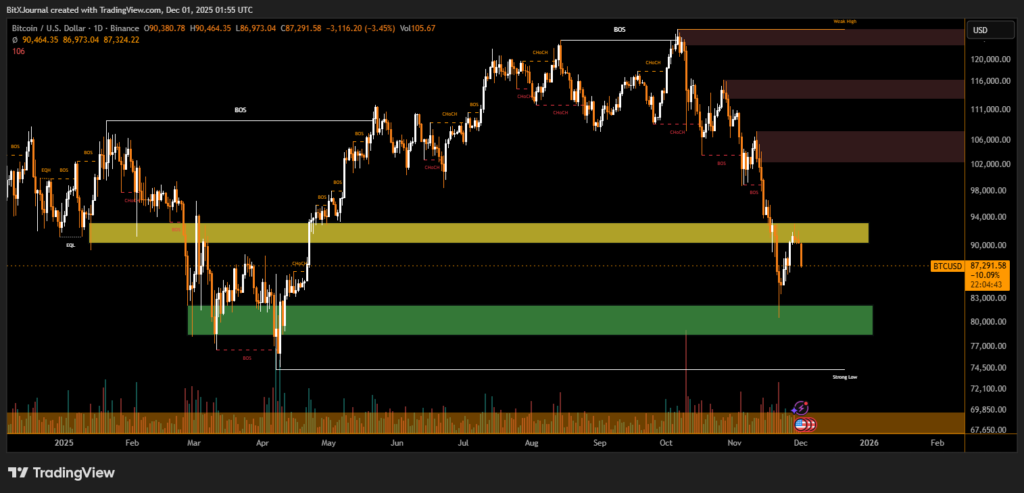

Bitcoin has dropped to $87,000, marking a sharp technical correction after several weeks of structural deterioration on the daily chart. The decline reflects a combination of market structure breaks, liquidity grabs, and a weakening bullish trend as shown by recent price action.

Technical Breakdown Behind the Drop

Recent price movements show Bitcoin trading through a major Break of Structure (BOS) on the daily timeframe, signaling a reversal from the previous bullish cycle. The chart indicates that price tapped into a premium zone before reversing, leaving behind a series of Change of Character (CHoCH) signals — early warnings of trend exhaustion.

The fall accelerated as Bitcoin slipped below a large distribution range, triggering sell-side liquidity. The decline pushed the market directly into a well-defined demand zone around $87K, where buyers have previously shown strong interest.

One of the most important details is the sweep of equal lows, suggesting that the market targeted resting liquidity before stabilizing. This indicates that the recent drop is not random but part of a structured move designed to clear out leveraged long positions.

The chart’s highlighted zones show that Bitcoin has tapped a critical demand area, though momentum still leans bearish. A clean reclaim above the mid-range near $90,000 would show strength, while failure to hold current levels opens the possibility of a deeper test toward the next strong support below $83,000.

Bitcoin’s slide to $87,000 is rooted in clear technical factors: broken structure, liquidity sweeps, and weakening bullish momentum. While the drop aligns with typical corrective behavior, traders will be watching whether this demand zone can sustain a recovery or if the trend continues lower.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.