Chainlink Technical Breakdown Amid Market Weakness

Chainlink’s LINK token continued its decline this week, slipping under the $12 threshold as broader crypto sentiment weakened. The pullback came even as the market anticipated the conversion of Grayscale’s Chainlink Trust into the first U.S. spot LINK ETF, a development that under different conditions might have supported prices. Instead, traders focused on deteriorating technical structure, signaling further downside pressure.

While ETF expectations often act as catalysts for digital assets, LINK’s reaction remained muted. The token’s inability to sustain recent support zones suggests that bullish catalysts were overshadowed by prevailing risk-off sentiment across major cryptocurrencies. Market participants note that institutional products can provide long-term value, but short-term price action continues to mirror technical behavior rather than headlines.

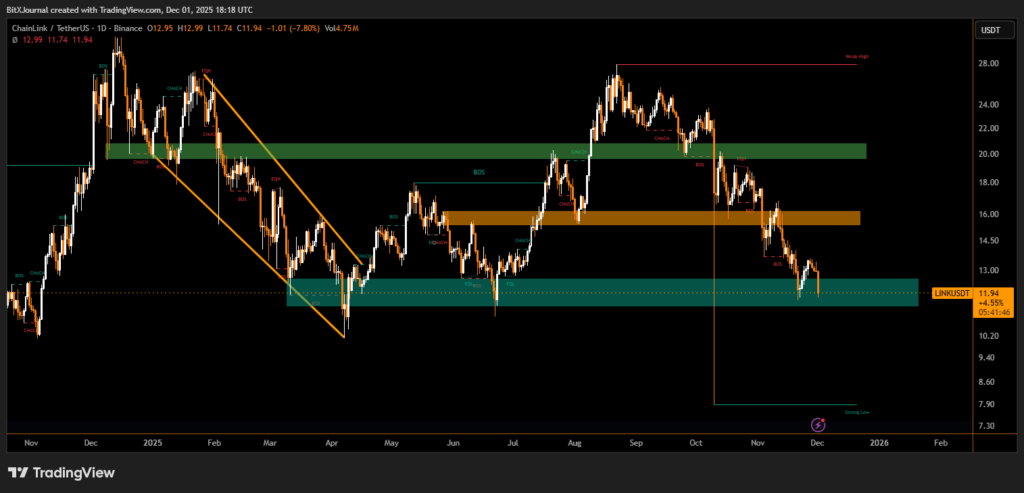

LINK’s latest breakdown reflects a sustained series of lower highs and weakening demand at prior support regions. The chart shows a decisive move beneath a previously defended liquidity pocket, reinforcing bearish momentum. According to current structure, immediate attention is centered on the $11.70–$11.80 zone, highlighted by analysts as a critical downside target.

The loss of this level could expose deeper liquidity areas established earlier in the year, signaling potential continuation of the downtrend.

Chainlink’s price action underscores a market environment where technical breakdowns outweigh fundamental or institutional developments. Until LINK reclaims key resistance levels, traders may continue to anticipate volatility and further testing of lower support regions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.