LINK ETF sees solid first-day trading but falls short of reversing token’s yearly losses

Grayscale’s launch of the first U.S. spot Chainlink (LINK) exchange-traded fund (ETF) attracted significant attention from investors seeking regulated exposure to altcoins. The debut demonstrates continued interest in institutional-grade crypto products, despite broader market volatility.

On its first trading day, the Chainlink ETF recorded $41 million in net inflows and roughly $13 million in trading volume, signaling a “solid” reception among investors. Compared to other altcoin ETFs, such as the Solana ETF which debuted with $8.2 million, Chainlink’s launch shows stronger investor appetite, though it remains behind the XRP spot ETF, which pulled in $243 million on its first day.

Fund Analysts Highlight Long-Tail Asset Potential

ETF analysts note that the Chainlink ETF’s total assets now exceed $64 million, including an initial $18 million seed allocation. The debut underscores that long-tail crypto assets—less liquid and less popular tokens—can achieve traction in regulated ETF formats, opening new avenues for diversified investment strategies.

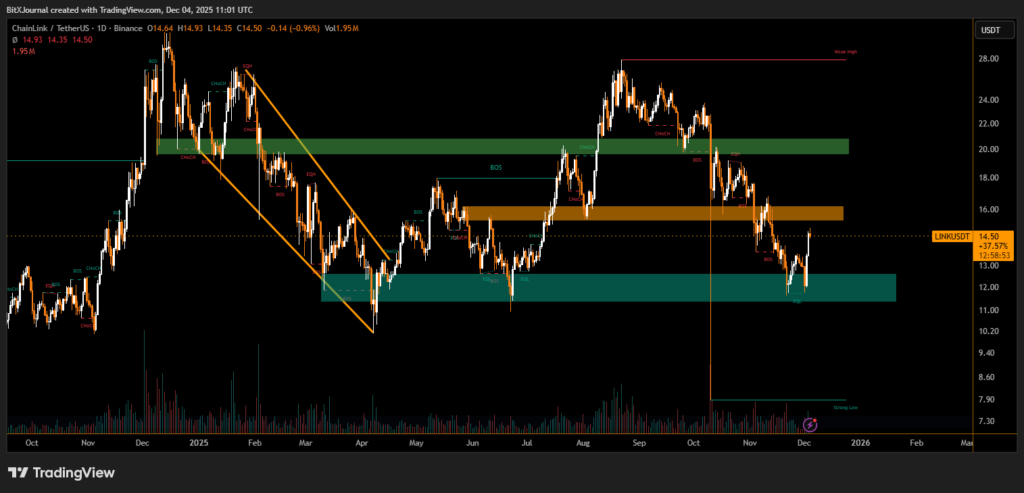

Despite the ETF debut, the LINK token has fallen 39% over the past year, with only a modest 9.8% rise over the past week. LINK remains integral to the Chainlink network, providing decentralized oracle services and cross-chain interoperability essential for smart contract execution and DeFi development.

While the Chainlink ETF is not a “blockbuster,” its launch reflects growing institutional interest in regulated altcoin exposure. The ETF market may increasingly support innovation and adoption for emerging digital assets within secure investment frameworks.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.