Analysts Highlight Tightening Supply and Early Signs of a More Supportive Liquidity Cycle

Crypto markets maintained a steady tone this week, with Bitcoin holding above $93,000 as on-chain data signaled declining exchange balances and easing liquidations. Analysts say these conditions reflect a period of quiet strength beneath otherwise muted price action, with broader liquidity dynamics turning positive for the first time in several years.

Bitcoin Supply on Exchanges Falls Toward 2017 Levels

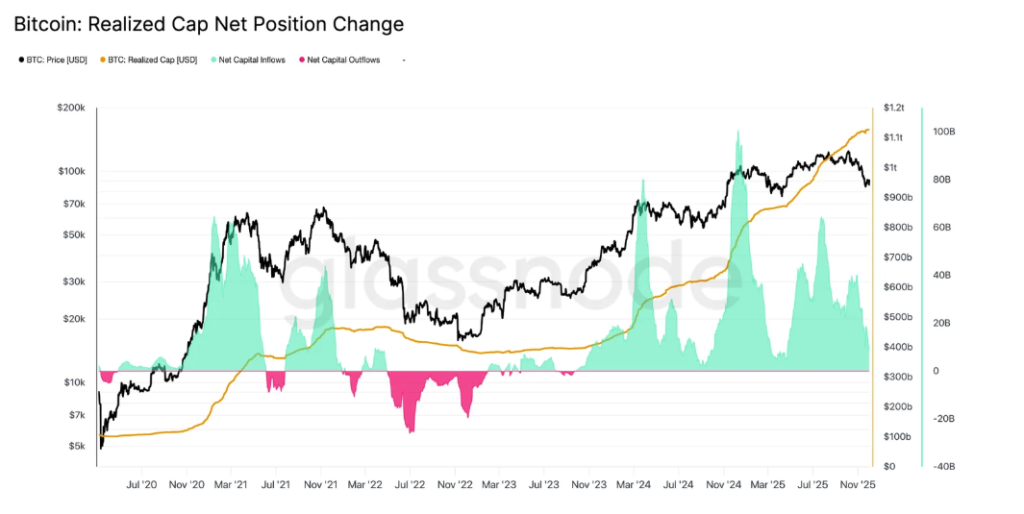

Researchers observed a notable drop in exchange balances to roughly 1.8 million BTC, marking the lowest level since 2017. This steady outflow underscores persistent accumulation and tightening supply, even as spot price momentum remains moderatee. Analysts pointed to continued positive realized-cap growth, indicating new capital is still entering the market.

They added that Bitcoin is stabilizing above key valuation metrics, though a decisive move into the $96,000–$106,000 range has yet to materialize.

Ethereum strengthened above $3,200, supported by renewed wallet accumulation and post-upgrade activity. Wallets holding 1,000–10,000 ETH have resumed aggressive buying, a pattern historically linked to periods of ETH outperformance. Daily address creation briefly neared 190,000, signaling organic post-upgrade network growth.

Other major assets such as Solana and BNB traded in a narrow range, while overall market capitalization hovered near $3.2 trillion.

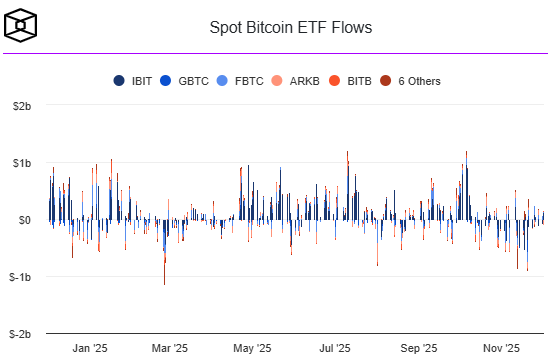

ETF Flows Diverge as BTC Levels Off

Spot Bitcoin ETFs recorded a modest $14.9 million net outflow, breaking a series of inflow sessions. In contrast, spot Ether ETFs attracted approximately $140 million, reflecting shifting investor appetite. Solana-focused products faced $32 million in outflows during the same period.

Leverage conditions showed signs of normalization, with total liquidations at roughly $312 million over the past day far lower than earlier in the week. Short positions accounted for the majority, suggesting more cautious positioning as Bitcoin approaches resistance levels.

Analysts say the macro backdrop is gradually improving. A record $13.5 billion U.S. Treasury buyback, expectations for another 25-bp Federal Reserve rate cut, and the end of quantitative tightening have created the first net-positive liquidity environment since early 2022. Forecasts now imply multiple additional cuts through 2026, forming a mild tailwind for major digital assets.

Together, thinning supply, stabilizing price structure and a supportive macro shift are fueling a cautiously constructive outlook for the months ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.