Market Volatility and Weak Sentiment Could Limit Early-Year Upside

Bitcoin’s strong start to 2025 may not repeat in early 2026, according to insights from 21Shares co-founder Ophelia Snyder who warns that current market conditions create headwinds for a January rebound. While long-term prospects remain intact, short-term optimism is fading as broader economic uncertainty weighs on investor sentiment.

Market Sentiment Weakens Despite Stable Fundamentals

Snyder noted that January typically brings renewed inflows into Bitcoin exchange-traded funds, as investors restructure portfolios at the start of the year. But this pattern may be disrupted. She emphasized that the ongoing downturn is tied to broader market risk-off behavior, not anything crypto specific, making it difficult for Bitcoin to stage a repeat rally.

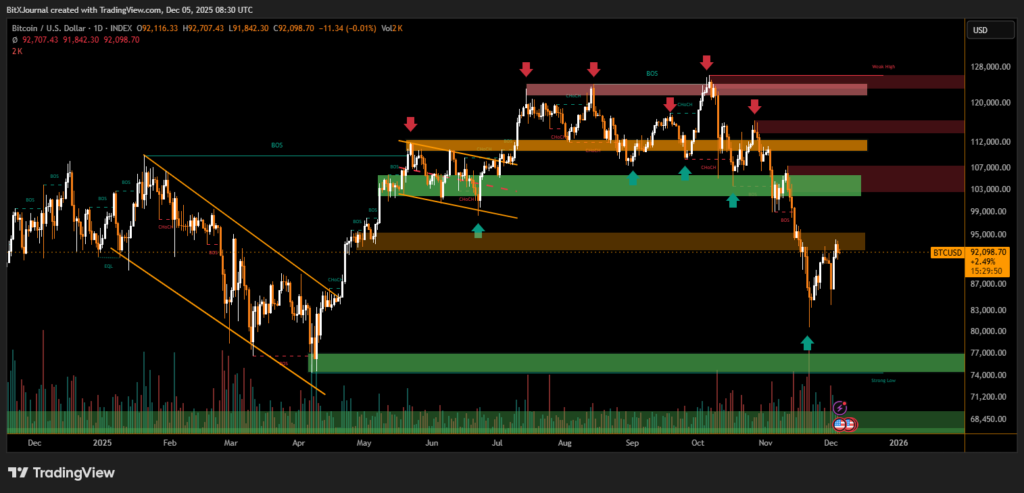

Bitcoin previously jumped to $109000 in early January 2025, fueled by expectations of pro-crypto policy shifts ahead of Donald Trump’s inauguration. After reaching a record $125,100 on Oct. 5, the asset reversed sharply following a $19 billion liquidation event, leading traders to reset expectations for the months ahead.

Long-Term Bullish Case Remains Intact

Despite a nearly 10% decline over the past 30 days, with Bitcoin now trading near $92,150, Snyder said the latest correction reflects macroeconomic caution rather than structural weakness in digital assets. She believes catalysts such as expanded access to crypto ETFs government adoption, and growing demand for alternative stores of value could support long-term appreciation.

Snyder warned that continued risk-off sentiment and strength in gold may weigh on Bitcoin as traditional investors search for stability. Still, not everyone shares her caution—some industry executives, including BitMine chair Tom Lee, expect Bitcoin to set a new high before January 2026. Historically, Bitcoin has posted an average 3.81% January gain since 2013.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.