A stronger yen and a potential BOJ rate hike to 0.75% may pressure global liquidity, adding new volatility to Bitcoin’s macro-driven market

Japan is preparing for what could be its most significant monetary shift in decades, with the Bank of Japan expected to raise interest rates to 0.75% at its December policy meeting. If delivered, the move would mark the country’s highest benchmark rate since 1995—and could disrupt global risk markets, including Bitcoin.

People familiar with the discussions say policymakers are leaning toward a 25-basis-point hike, provided no major economic shocks emerge. The yen strengthened immediately after reports surfaced, climbing from above 155 to around 154.56 per dollar.

At the center of the market reaction is the potential unwinding of the yen carry trade, a long-standing macro strategy where hedge funds borrow yen at low rates to invest in higher-yielding assets. Higher Japanese rates make this trade less attractive, increasing the likelihood that investors pull back from leveraged positions—including those tied to Bitcoin.

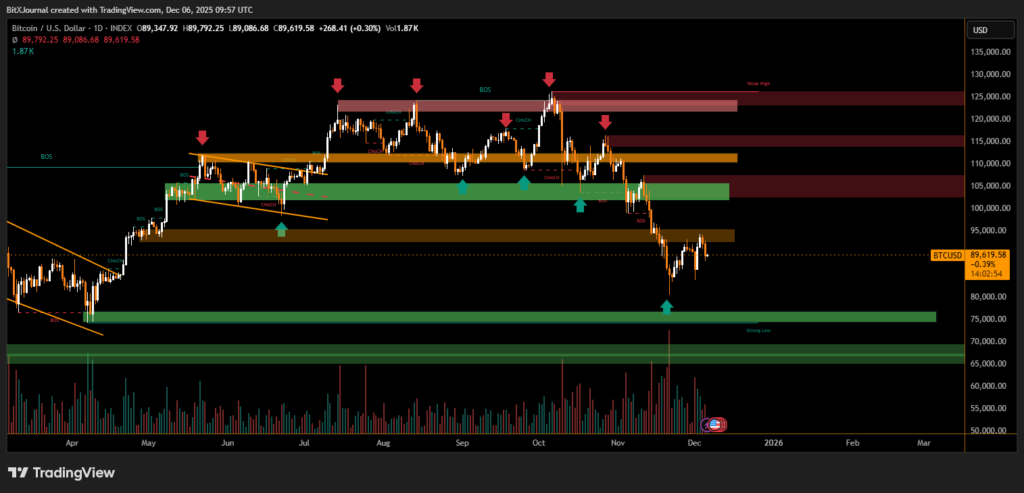

A stronger yen typically triggers de-risking across macro portfolios, tightening liquidity conditions that have supported Bitcoin’s rebound from November’s lows. BTC briefly slipped toward $86,000 earlier this week before recovering above $93,000 alongside U.S. equities, but remains highly sensitive to global rate expectations.

Governor Kazuo Ueda signaled this week that the BOJ would make an “appropriate decision,” echoing language used ahead of previous hikes. Market pricing now reflects nearly a 90% probability of a December increase, and Prime Minister Sanae Takaichi’s cabinet is not expected to oppose the shift.

For Bitcoin traders, the key risk lies not in Japan’s final rate level but in the long-term retreat from a decades-old source of global liquidity. If funding costs continue to rise, leveraged macro funds may scale back exposure to BTC and other high-volatility assets. Still, analysts note that a gradual BOJ tightening—paired with rising odds of U.S. rate cuts—may limit near-term damage, provided global equities avoid sharp declines.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.