Scaling back Reality Labs spending by up to 30% may boost Meta’s earnings and lift its share price by more than 20%, according to new analyst estimates

Meta is reportedly weighing deep reductions to its Reality Labs division, a shift analysts say could mark one of the company’s most consequentiial strategic pivots since its metaverse-focused rebrand. Cutting back metaverse investments—long viewed by investors as a costly drag—could immediately free up billions for Meta’s fast-growing AI initiatives.

In a recent note, analysts at Mizuho characterized Reality Labs as an “$80 billion black hole” of cumulative operating losses, underscoring years of spending that have far exceeded consumer adoption of products like Quest headsets and Horizon Worlds. The firm estimates that up to 30% in cost reductions would strengthen Meta’s earnings profile, potentially adding about $2 per share to 2026 earnings.

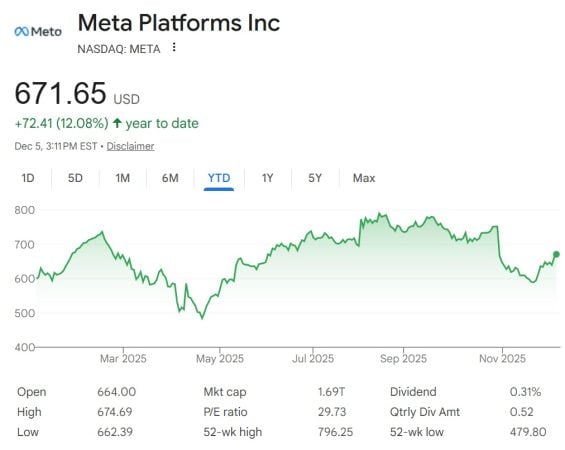

The analysts reaffirmed an Outperform rating with an $815 price target, implying a more than 21% upside from the stock’s current $672 level. Their bull case projects a valuation as high as $1,245, driven by stronger AI-led revenue growth.

Recent sentiment among institutional investors reflects growiing skepticism toward the metaverse strategy. Conversations tracked by analysts show a broad view that a retrenchment is overdue. Earlier this year, an internal memo from CTO Andrew Bosworth warned that mixed-reality efforts were entering a defining moment—one that could be remembered as either visionary or a “legendary misadventure.”

Sources familiar with Meta’s 2026 planning say leadership is evaluating 30% division-wide cuts, a far deeper targeet than the roughly 10% reductions under consideration in other units. Potential layoffs could follow, though decisions remain pending.

Reality Labs has posted more than $70 billion in losses since 2021, while user traction in Horizon Worlds continues to lag. At the same time, the broader metaverse-token sector has collapsed, with category valuations falling below $3.2 billion, down from over $500 billion earlier this year. Tokens like Sandbox, Render, and MANA are trading near record lows, reflecting widespread doubt about virtual-world growth prospects.

Analysts say rebalancing capital toward AI may finally align Meta’s spending with areas of clear demand—while easing years of pressure from shareholders who have questioned the metaverse’s diminishing returns.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.