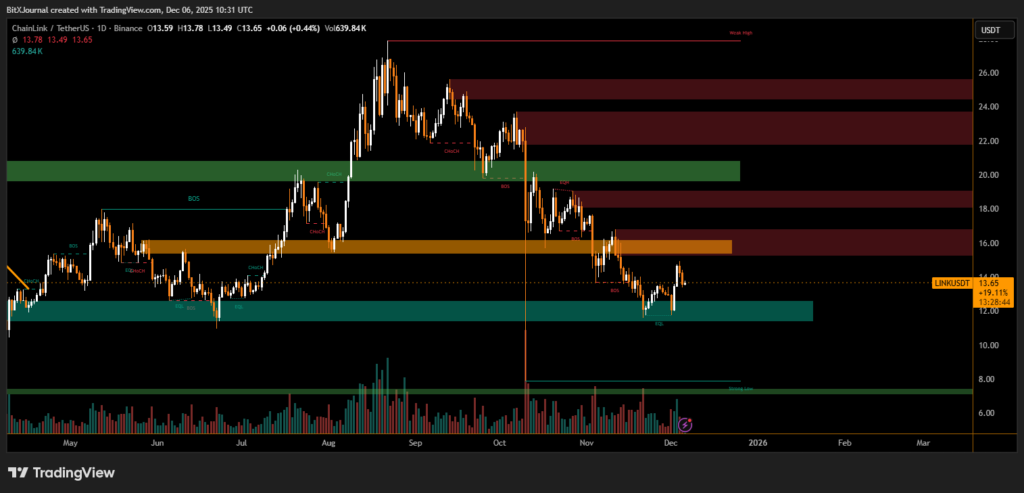

Chainlink is experiencing a fresh wave of volatility as the token slipped nearly 3%, reflecting broader uncertainty across the digital asset market. The latest daily chart signals a critical technical moment for LINK, with price action testing key support and struggling to reclaim lost bullish momentum.

Recent trading shows Chainlink hovering around the $13.65 area, where buyers and sellers are battling for short-term control. The chart illustrates several notable zones, including a broad demand region beneath $12, which has historically triggered rebounds. This area is now being monitored closely as a potential reaction point if downward pressure continues.

In the mid-range, a cluster of resistance between $15 and $16 remains a major barrier. Price previously attempted to break through this zone but failed, resulting in a sharp rejection and subsequent decline. The structure highlights a series of break-of-structure (BOS) and change-of-character (CHoCH) signals, suggesting that bullish momentum weakened earlier than expected.

Higher up, a large supply block near $19–$21 marks the threshold where long-term sellers have repeatedly stepped in. Until buyers reclaim this region, upside continuation remains limited. The market also shows a “weak high” in the upper around $26, indicating that any extended rally would still face layered resistance.

As LINK trades within a compressed range, market participants are watching for a decisive move. A breakdown below the current support could open the door to deeper tests, while a reclaim of the mid-range could shift momentum back toward recovery.

Overall, the market structure reflects heightened caution, with traders awaiting clearer signals before committing to new positions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.