Rising global M2 liquidity and expectations of a Fed rate cut set the stage for a potential year-end rally, though cautious sentiment and Powell’s guidance may limit momentum

Bitcoin may be positioned for a December recovery as macroeconomic conditions turn more supportive, according to new analysis from Coinbase Institutional. Rising global liquidity and a sharp increase in expectations for a Federal Reserve rate cut are creating a more favorable backdrop for digital assets after weeks of market uncertainty.

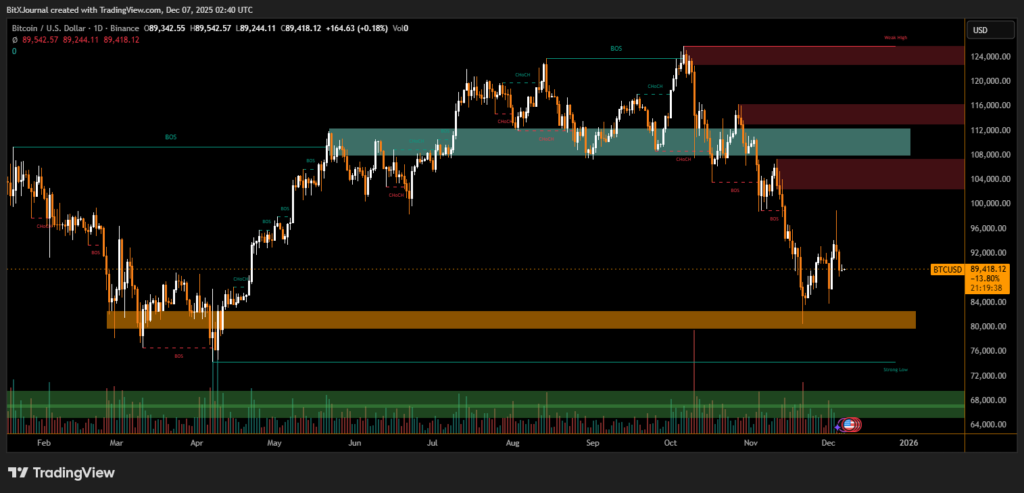

Coinbase noted that improving monetary conditions, combined with stronger odds of a rate cut — now estimated at 92% as of Dec. 4 — could fuel a rebound. The firm’s outlook aligns with its earlier forecast of weakness leading into a potential “December reversal,” based on its proprietary global M2 money supply index, which tracks changes in the broader fiat currency supply.

However, sentiment remains fragile. Fear continues to dominate both retail and institutional behavior, with investors waiting for clearer signals from ETF flows and macro policy before re-entering the market.

Analysts also highlight the possibility of a traditional “Santa rally” if the Fed cuts rates on December 10. Yet, Bitcoin’s trajectory into early 2026 may depend heavily on Federal Reserve Chair Jerome Powell’s messaging. Even a mildly hawkish tone could cap upside.

Market observers say Powell’s previous remarks contributed to November’s selling pressure, but expect December conditions to improve. Chris Kim, CEO of quantitative trading fund Axis, noted that Bitcoin has already retested the $80,000 region and key long-term averages, adding that incremental factors — such as expanded ETF access — support a recovery outlook.

Looking ahead, speculation surrounding National Economic Council Director Kevin Hassett as a potential Fed Chair nominee is drawing attention. A leadership shift toward a more dovish stance could become another influential catalyst for crypto markets in early 2026.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.