Clean supply dynamics and renewed investor demand position BCH as the standout L1 amid broad market weakness.

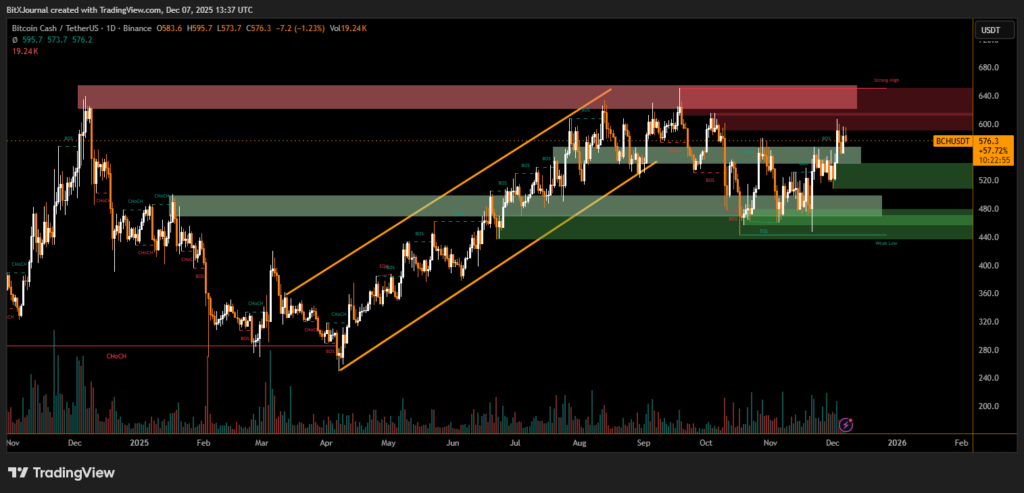

Bitcoin Cash has surged nearly 40% this year, emerging as the best-performing Layer-1 blockchain of 2025. New market data shows BCH outperforming every major L1 network, even as much of the sector struggles with steep year-to-date declines.

BCH Outpaces Top Layer-1 Competitors

Fresh analysis from market researcher Crypto Koryo shows Bitcoin Cash outperforming BNB, Hyperliquid, Tron and XRP, all of which recorded only modest gains. In contrast, several major chains—including Ethereum, Solana, Avalanche, Cardano and Polkadot—remain deep in negative territory, with some down more than 50% this year.

Koryo noted that BCH’s leadership is particularly striking given that the project does not maintain an official X (Twitter) presence, yet still continues to draw sustained market interest.

Supply Structure Strengthens Price Performance

Analysts point to Bitcoin Cash’s clean supply profile as a major contributor to its strength. The network has:

- No token unlocks

- No foundation-controlled treasury

- No venture-capital allocations waiting to sell

This means the entire supply is already circulating, significantly reducing structural sell-side pressure. These supply characteristics have made BCH one of the few L1s enjoying consistent capital inflows in 2025.

Market Outlook for Bitcoin Also Turns Cautious

Meanwhile, Bitcoin may be positioned for a short-term correction. Analyst Michaël van de Poppe expects a potential dip toward $87,000 ahead of the upcoming Federal Reserve meeting. He anticipates a rebound if BTC recovers above the key $92,000 level, which could open a path toward the $100,000 zone within weeks.

The outlook is tied to a supportive macro environment, including reduced quantitative tightening, rising liquidity and anticipated rate cuts. However, losing the critical $86,000 support could send BTC toward $80,000 instead.

Additional on-chain signals suggest Bitcoin’s broader bull cycle remains healthy. Analyst TXMC highlights a rise in Bitcoin’s liveliness indicator, a long-term measure of coin movement versus holding. The increase points to strengthening underlying demand, even as price action appears muted.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.