Break below the 0.382 retracement zone could trigger a revisit of April’s lows, market strategists caution

Bitcoin is testing a crucial technical zone that analysts say must hold to prevent a deeper correction. The market’s focus has shifted toward a key Fibonacci retracement level, with traders closely monitoring whether bulls can maintain control amid heightened volatility.

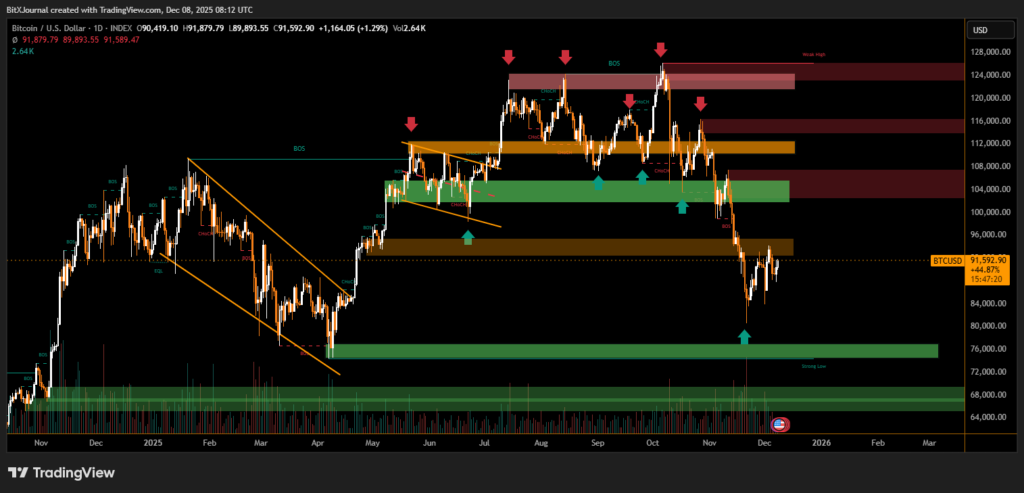

Crypto analyst Daan Crypto Trades highlighted that Bitcoin is currently positioned at the 0.382 Fibonacci retracement, a level often viewed as a major support-resistance pivot during broader market cycles. “This is a key area for the bulls to defend,” he noted, adding that a decisive break could send Bitcoin back toward April’s lows near $76,000. A decline to that level would “break the high time frame market structure,” signaling a more extended downturn.

Over the weekend, Bitcoin briefly dipped below $88,000 during a sharp leverage flush that liquidated long and short positions. It quickly rebounded above $91,500, with market commentators describing the move as typical low-liquidity weekend volatility designed to wipe out overexposed traders.

Beyond technical levels, traders are watching this week’s Federal Open Market Committee meeting, with a 0.25% rate cut widely anticipated. Analysts, however, say the tone of the Fed’s outlook may matter more than the cut itself. Market momentum has softened since October’s rate change, with Fed Chair Jerome Powell emphasizing a data-dependent easing path.

Research firms note that declining volumes and negative ETF flows have left upside participation limited. This keeps Bitcoin trading within the $70,000–$100,000 range, where compressed volatility makes downside risks more significant.

Analysts remain cautiously optimistic for 2026, pointing to expectations of additional rate cuts next year as supportive for broader risk assets, including digital currencies.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.