Key Support Holds as ETF Demand Crosses Major Milestone

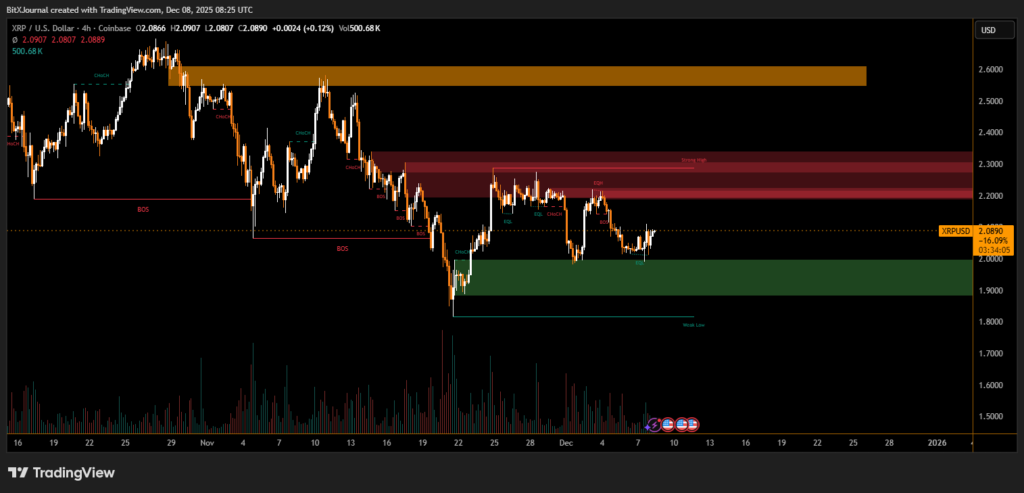

XRP has shown renewed resilience after rebounding sharply from the critical $2.00 support zone, a level that continues to act as a psychological anchor for market participants. The chart highlights a decisive reaction from this area, suggesting that institutional buyers stepped in aggressively to defend the level, even as retail participation remains comparatively limited.

The latest market flows reflect rising confidence among larger investors. Institutional demand for XRP-linked ETFs has now exceeded $1 billion, a sign that professional capital is positioning for long-term exposure rather than short-term speculation. This trend contrasts with the muted retail activity, underscoring a market driven more by structured accumulation than momentum trading.

Technical structure reinforces this narrative. After the liquidity sweep near the $2.00 demand block, XRP stabilized and began forming a tighter consolidation beneath local resistance. A clean breakout above $2.11 is essential to unlock the next phase of upward momentum, as this level marks the boundary of an unmitigated supply zone visible .

If bulls manage to maintain pressure, the next resistance lies in the $2.20–$2.35 region, an area where previous rallies have stalled. A confirmed move through this range could open the door toward higher mid-range targets heading into the new year.

For now, the market structure remains constructive. The $2.00 floor continues to serve as a strong defense line, reinforcing the broader view that institutional interest is supporting XRP’s stability even in periods of reduced retail enthusiasm.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.