European Trading Hours Record Deepest Bitcoin Selling Since 2018, but ADA Maintains Support Structure

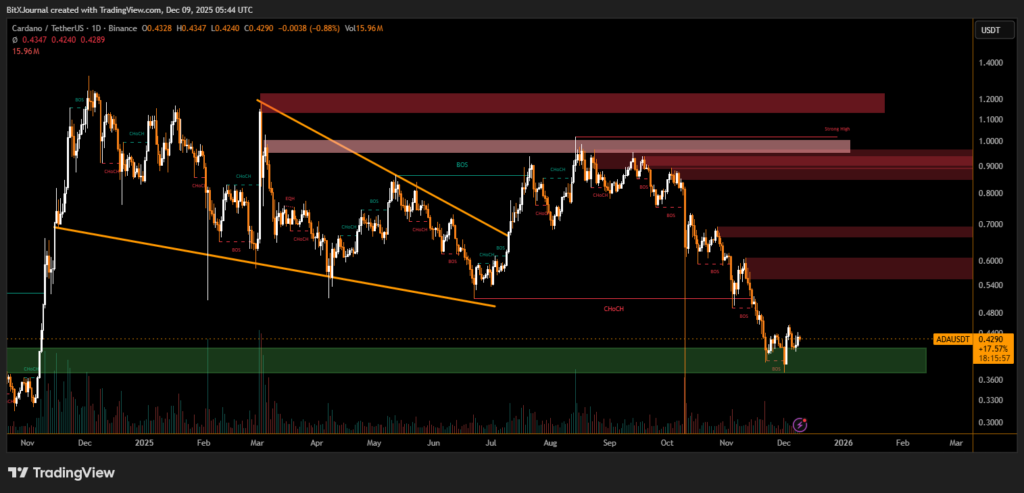

Cardano (ADA) traded steadily above its major demand zone near $0.40, even as market data showed that European traders were responsible for the deepest Bitcoin selloff recorded during their timezone since 2018. Despite this pressure on the broader crypto market, ADA’s structure has remained resilient, with buyers consistently defending the lower boundary of the current range.

Over the past week, the entire market has attempted to stabilize after a sharp decline, but liquidity remains notably thin ahead of Wednesday’s Federal Reserve decision—a macro event that historically influences short-term volatility across digital assets. Cardano’s price action reflects this caution. After breaking down from higher supply zones earlier this quarter, ADA found support at the same demand region that previously sparked multiple rebounds throughout the year.

The market shows how the price has consolidated within this support block, with internal breaks of structure suggesting controlled accumulation rather than panic-driven selling. Volume remains moderate, highlighting that most participants are waiting for clarity from policymakers before committing to new positions.

Still, ADA’s resilience is noteworthy. Holding above $0.40 keeps the asset positioned for a potential recovery, provided broader risk sentiment improves. Any move toward the $0.46–$0.50 resistance band would require renewed momentum and stronger liquidity inflows.

For now, Cardano’s steady posture amid wider market uncertainty signals that buyers are maintaining confidence at lower levels, even as macro factors continue to shape short-term direction.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.