Stablecoin Issuer Explores Digital Shares Following Push Toward $500 Billion Valuation

Tether is considering whether to tokenize its equity after initiating a major fundraising effort that could bring in up to $20 billion and value the company at roughly $500 billion according to recent reports. The move reflects growing interest in blockchain based ownership models as the firm evaluates options for shareholder liquidity.

The company does not plan to let existing investors sell shares into the primary round, creating a potential gap before any eventual public listing. As a result, executives are exploring tokenized shares or traditional buybacks as possible channels for investors seeking liquidity. No final decision has been made on the structure.

In 2024, Tether launched Hadron, a tokenization unit designed to mint blockchain-based versions of stocks, bonds, and commodities. Any equity tokenization framework could build on that infrastructure, offering investors digital representations of ownership should the company move ahead.

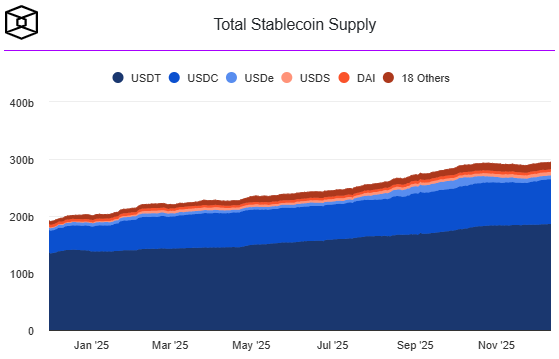

Tether’s flagship stablecoin, USDT, remains the largest in circulation with about $186 billion outstanding, and the firm expects $15 billion in profit this year. Internal tensions have surfaced around secondary sales, with the company reportedly blocking discounted stock transactions that would have valued Tether far below its target.

A $500 billion valuation would place Tether among the world’s most valuable private companies, underscoring investor demand as tokenized-asset markets gradually expand in 2025 despite still representing a small share of global financial assets.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.