This week’s crypto market reflected ongoing macro pressures and subdued investor risk appetite. Bitcoin, Ethereum, XRP, and Solana showed range bound price action amid broader liquidity tightening concerns and slowing trading volumes. In parallel gold prices climmbed modestly driven by global rate cut expectations from the U.S. Federal Reserve.

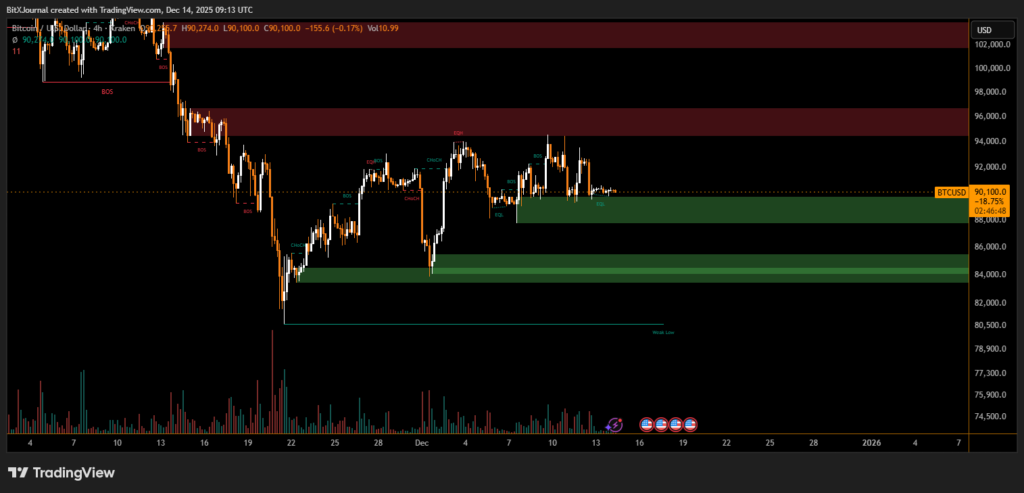

Bitcoin traded near the low-$90,000 range, with data showing BTC around $90,270 , price that has remained relatively flat but volatile over the week.

Despite occasional intraday spikes, Bitcoin failed to break decisively above key resistance zones, indicating a market lacking strong bullish conviction. Lower spot trading volumes have contributed to thinner order books and choppy directionaal moves.

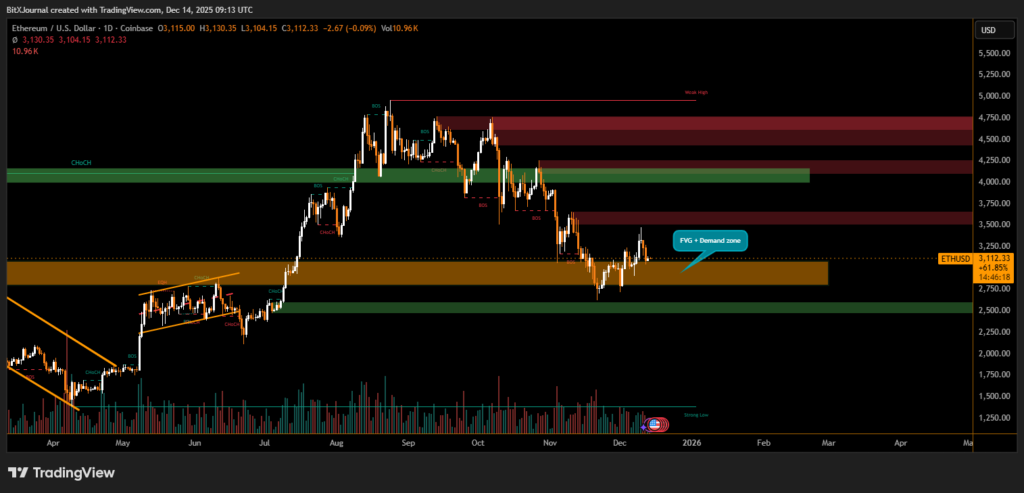

Ethereum (ETH) hovered around the $3,110–$3,120 range through the week, showing modest consolidation.

The token oscillated with mild momentum but ultimately stayed within a tight trading band, suggesting that traders are hesitant to commit amidst uncertain macro signals.

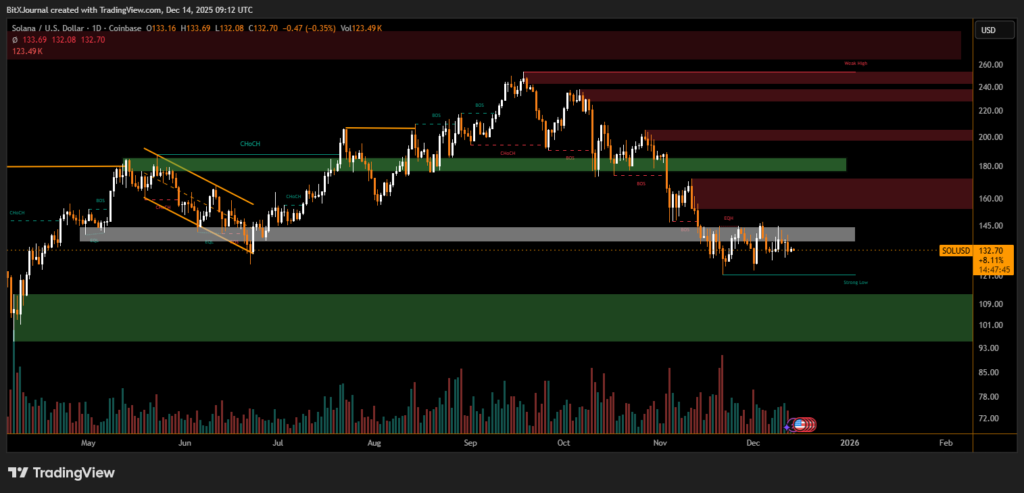

Solana’s SOL stayed subdued, ending the week near $133 per token.

After dipping from higher levels early in the month, SOL’s movement reflected broader crypto weakness, even as some institutional products likee Solana ETFs saw inflows a sign of selective investor interest.

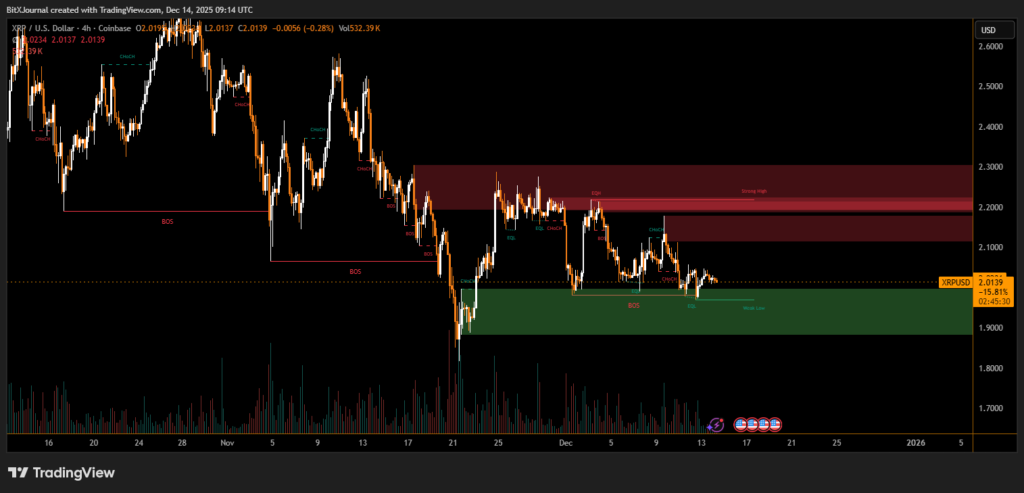

XRP traded slightly above $2, maintaining support at this critical level amid broader market stagnation.

The asset’s mild range-bound behaviour underscores investor caution as the market evaluates macro cues and legal/regulatory developments around digital assets.

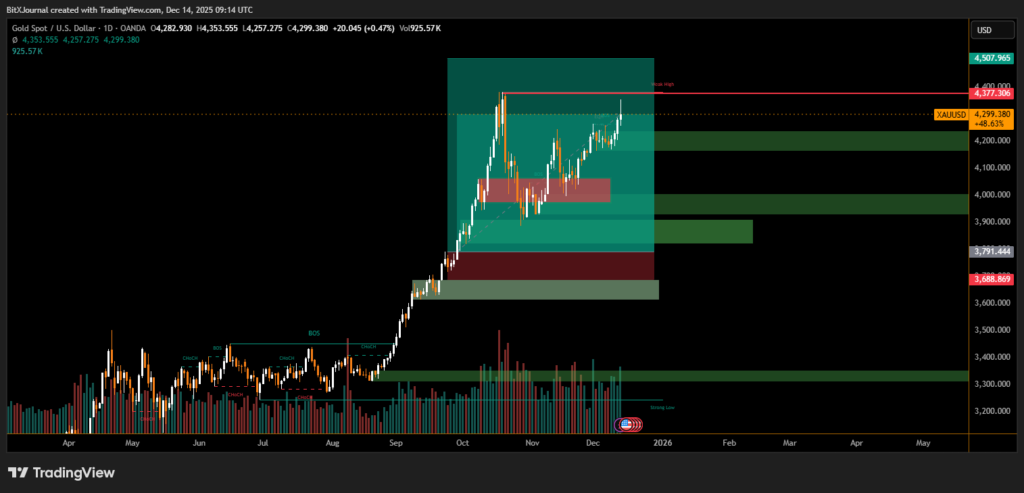

Gold prices edged higher this week amid unfolding Fed rate cuts, with data pointing to strong safe-haven demand as macro uncertainty persists.

The Federal Reserve’s recent rate reduction signalled an easing bias that lifted gold but also created mixed sentiment in risk assets, as traders parsed how far monetary support might extend.

Across major exchanges, spot trading volumes have declined, reflecting investor hesitation and reduced speculative momentum. Lower volume trends often signal consolidating markets and can delay sustained breakouts in major crypto price charts.

This week’s market was defined by modest price movement in crypto and gold, a cautious reaction to macro shifts including Fed rate cuts, as well as a noticeable pullback in spot trading volumes. Traders remain watchful for fresh catalysts to break the current stalemate.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.