Risk-off sentiment, profit-taking, and technical rejection push BTC lower

Bitcoin slipped to the $88,000 level, extending its recent pullback after failing to reclaim key resistance zones. The move reflects growing caution across risk assets, with traders responding to macro uncertainty, equity market weakness, and visible technical exhaustion following earlier highs.

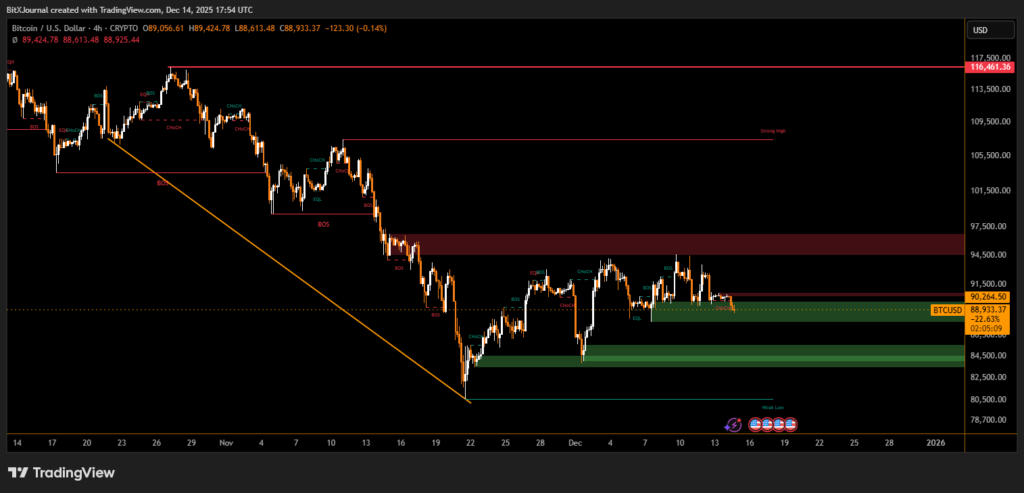

From a market structure perspective, Bitcoin encountered strong overhead resistance near the $92,000–$94,000 range, where multiple prior supply zones were concentrated. Repeated failures to sustain momentum above this area triggered sell side liquidity resulting in a sharp move lower. The breakdown confirms a short term bearish bias marked by lower highs and a loss of bullish structure on intraday timeframes.

Importantly, price slipped below a consolidation range that had acted as temporary support, accelerating downside pressure toward $88,000.

Beyond technicals, broader financial conditions played a role. Weakness in U.S. equities particularly technology stocks, reduced appetite for speculative assets. Investors also reacted to shifting expectations around monetary policy, with growing debate over the pace and depth of future rate cuts. As risk sentiment softened, leveraged crypto positions were unwound, adding to downside momentum.

Bitcoin is now hovering near a demand zone between $85,000 and $88,000, an area that previously attracted buyers. A sustained hold could stabilize price action, while a decisive breakdown may expose deeper downside toward prior swing lows.

Until Bitcoin reclaims key resistance above $90,500, upside attempts may remain capped. The current move underscores a broader market reset, where patience and confirmation are likely to define the next directional trend.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.