DOGE Market Reacts to Rate Cut With Sharp Sell-Off

Dogecoin experienced a notable price decline after the latest Federal Reserve rate cut announcement triggered heightened volatility across the crypto market. The move intensiified selling pressure on DOGE, pushing the price below a critical technical level and raising fresh concerns about short-term trend stability.

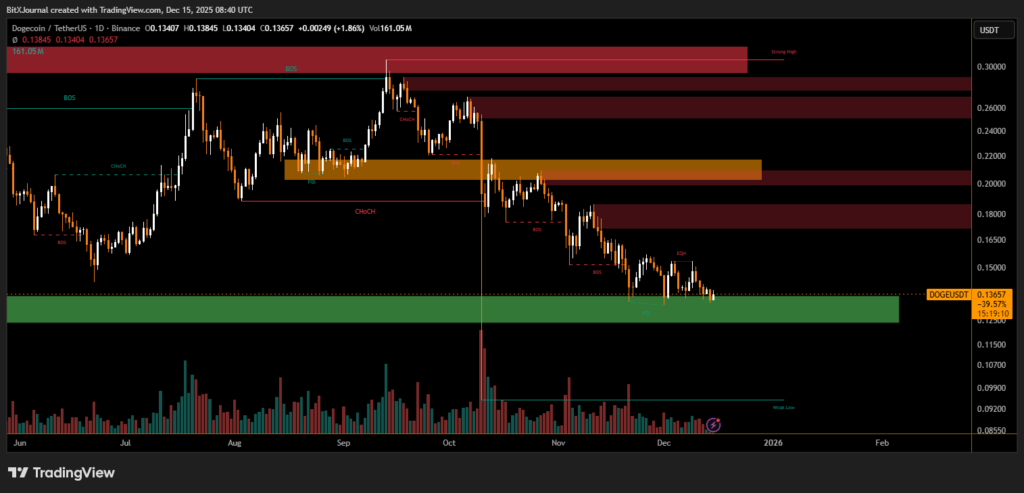

Following the macroeconomic announcement, Dogecoin fell decisively below the key support level at $0.1407. This breakdown acted as a catalyst for accelerated selling, with volume expanding sharply as traders exited positions. The price slid to an intraday low of $0.1372, confirming the loss of bullish control that had previously defended the zone.

Technical structure shows a continuation of lower highs and lower lows, reinforcing the broader bearish bias. The rejection from higher resistance areas earlier in the month left DOGE vulnerable once macro pressure increased.

Despite the sharp decline, downside momentum is beginning to show early signs of fatigue. The $0.1372 level is emerging as an important short term support where selling pressure slowed and price stabilized. Volume has started to normalize, suggesting that aggressive liquidation may be easing for now.

However, sustained recovery will depend on whether buyers can reclaim the broken $0.1407 level. Failure to do so keeps the risk tilted toward further consolidation or another leg lower.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.