Bitcoin Price Vulnerability Amid Macro Shifts and Quantum Risk

Global macro analyst Luke Gromen has adopted a near term bearish stance on Bitcoin, suggesting the cryptocurrency could fall to the $40,000 range in 2026. While historically a proponent of Bitcoin as part of the debasement trade, Gromen now highlights concerns over macro conditions, technical signals, and emerging quantum risk narratives.

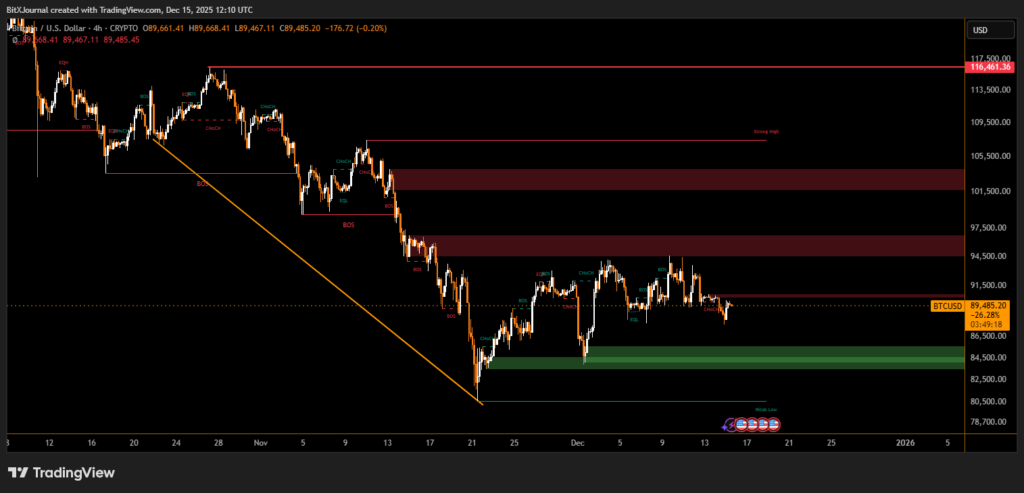

Gromen noted that Bitcoin has underperformed compared to gold, failing to reach new highs and breaking key moving averages. He emphasized that although fiat currencies may continue to lose value over time, Bitcoin’s risk-reward profile has worsened in the near term, making tactical downsizing of positions prudent.

The analyst also flagged quantum computing risks as a growing factor in market sentiment, despite most cryptographers considering practical attacks on Bitcoin’s cryptography still distant. Combined with macro uncertainty weaker US economic data, and AI sector jitters these factors contribute to a cautious near-term outlook.

However, some Bitcoin-focused analysts challenge Gromen’s bearish view, arguing that technical breaks and gold comparisons are insufficient to predict a major decline. Market flows, including modest inflows into US spot Bitcoin ETFs, suggest that the long-term debasement thesis supporting Bitcoin and gold remains intact.

Gromen’s revised stance underscores the importance of balancing long-term bullish fundamentals with short-term tactical caution, reminding investors that even macro-aligned supporters may adjust Bitcoin exposure when narratives and charts signal elevated risks.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.