Cathie Wood’s firm adds BitMine, Coinbase, and Circle shares as prices slide across crypto-linked equities.

Ark Invest has moved to buy the dip in crypto-related equities increasing its exposure after a broad market sell-off. The purchases suggest continued conviction in digital asset infrastructure despite short-term volatility affecting both equities and cryptocurrencies.

According to disclosed trades, Ark Invest added approximately $17 million in BitMine shares, alongside about $16.26 million in Coinbase and roughly $10.8 million in Circle Internet Group. These acquisitions were spread across multiple exchange-traded funds, reinforcing Ark’s diversified approach to crypto exposure.

The firm also expanded positions in Block Inc. ($5.94 million), Bullish exchange shares ($5.2 million), and its spot Bitcoin ETF ($1.24 million). All of these assets recorded losses during the same trading session.

Market Performance Context

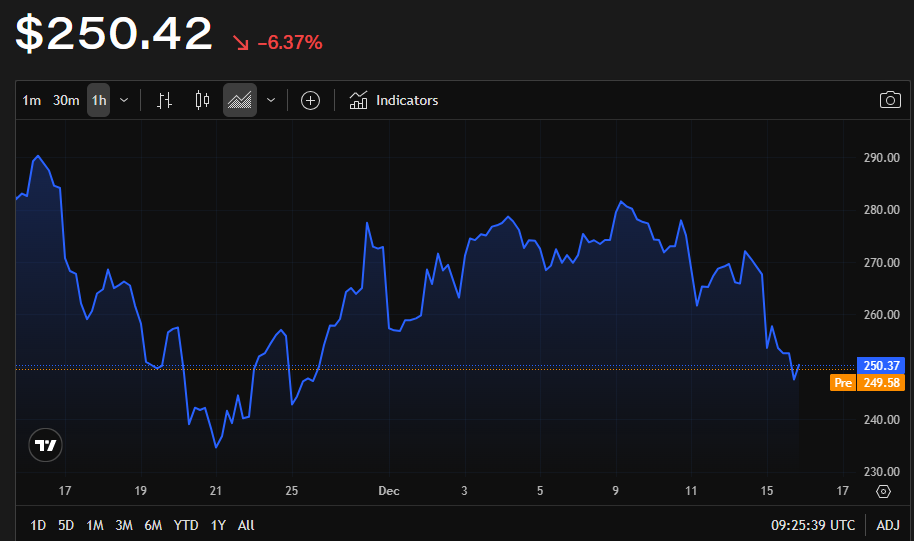

On the day of the purchases, BitMine declined over 11%, while Coinbase fell more than 6% and Circle dropped nearly 10%. Broader market weakness was also evident as Bitcoin slipped around 4% and Ether declined close to 6%, reflecting cautious investor sentiment.

The buying activity aligns with Ark Invest’s longer-term view that technological innovation may contribute to deflationary pressures ahead. By accumulating shares during market weakness, the firm appears to be positioning for potential upside as digital asset markets stabilize.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.