Institutional demand grows as investors rotate beyond Bitcoin and Ethereum

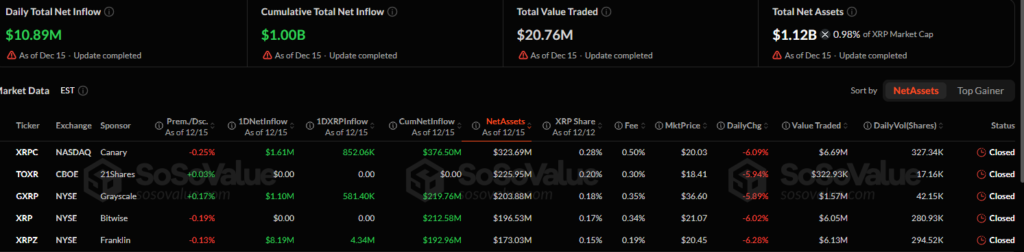

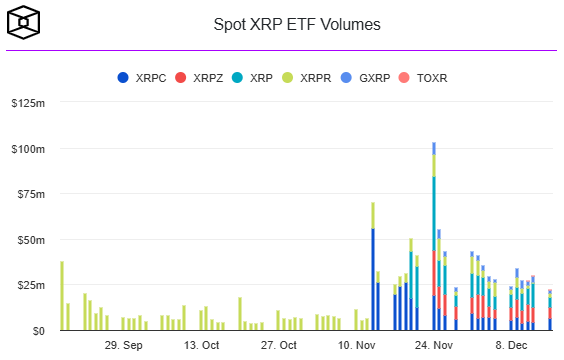

U.S.-listed spot XRP exchange-traded funds have surpassed $1 billion in cumulative inflows, highlighting rising institutional interest in regulated crypto products beyond Bitcoin and Ethereum. The milestone comes just weeks after the first spot XRP ETF began trading in mid-November, underscoring strong early momentum.

Spot XRP ETFs Record Steady Capital Inflows

On the latest trading day, spot XRP ETFs attracted nearly $11 million in net inflows, pushing total inflows above the $1 billion mark. Multiple issuers contributed to the gains, signaling broad based demand rather than concentration in a single fund. The performance positions XRP ETFs as one of the fastest-growing altcoin ETF categories in the U.S. market.

Market participants point to improving regulatory clarity around XRP as a key driver of interest, with investors seeking diversified crypto exposure through compliant investment vehicles.

While XRP ETFs advanced spot Bitcoin and spot Ethereum ETFs recorded significant net outflows on the same day. Bitcoin-linked funds saw their largest single-day withdrawal in several weeks while Ethereum ETFs also experienced notable capital exits. The divergence suggests a rotation of capital toward alternative digital assets with differentiated growth narratives.

Broader market volatility and macroeconomic uncertainty have weighed on Bitcoin prices, prompting investors to reassess positioning. In contrast, XRP ETFs’ consistent inflows reflect growing confidence in select altcoins as institutions expand their crypto allocation strategies.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.