Onchain Data Signals Distribution Phase May Be Ending in 2026

Bitcoin’s extended period of sell side pressure appears to be approaching a turning point. K33 onchain research indicates that long term holders have distributed a significant portion of supply over the past two years, a trend that may soon stabilize as market dynamics shift toward renewed buy-side demand.

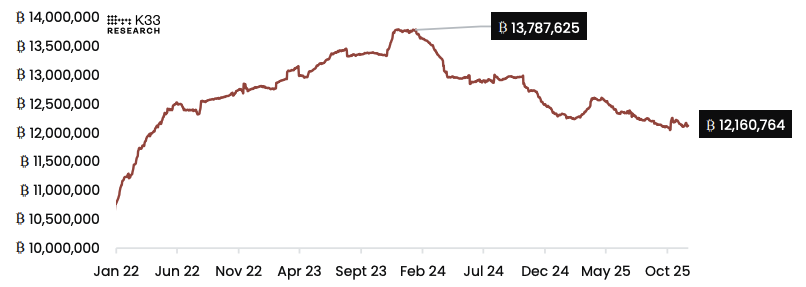

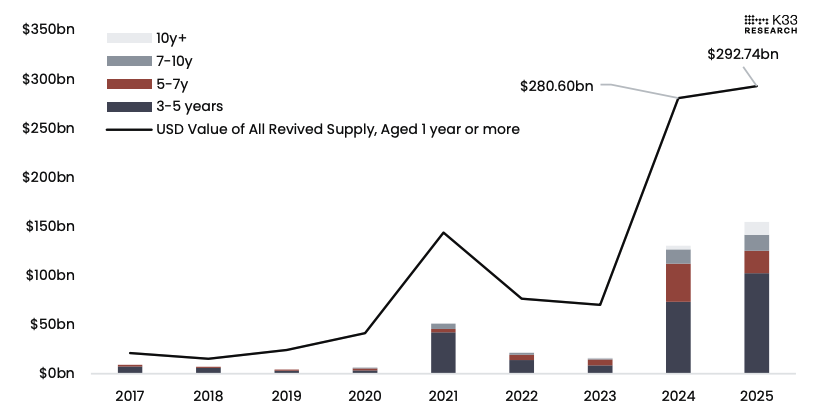

Recent analysis shows that around 20% of Bitcoin’s total supply has been reactivated over the last two years, representing one of the largest long-term holder distribution phases on record. Since 2024, approximately 1.6 million BTC worth about $138 billion at current prices has moved from wallets inactive for more than two years back into circulation.

This scale suggests deliberate selling rather than routine wallet maintenance. While ETF related restructuring, custody upgrades and internal transfers account for some movement, they fail to explain the overall magnitude of revived supply.

Institutional Liquidity Reshapes Bitcoin Ownership

Unlike previous cycles driven by speculative activity, the current distribution phase reflects direct selling into deep institutional liquidity, fueled by U.S. spot Bitcoin ETFs and growing corporate treasury demand. Several large over-the-counter transactions involving tens of thousands of BTC underscore this trend.

In total, nearly $300 billion worth of BTC aged one year or more has been revived in 2025 alone, contributing to Bitcoin’s relative underperformance this year.

With much of the long term supply already redistributed, analysts expect sell side pressure to approach saturation. As early holders reduce selling, Bitcoin’s two-year supply base is projected to recover in 2026, potentially setting the stage for a shift toward net buy-side demand supported by broader institutional participation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.