Markets react as a new Fed leadership promise sparks speculation on BTC’s future

President Donald Trump recently announced that the next Federal Reserve chair will prioritize “much lower” interest rates, a move aimed at easing financial market tensions ahead of the 2026 midterms. This potential shift in monetary policy has fueled speculation that Bitcoin and cryptocurrencies could enter a favorable environment for growth.

Potential Impact on Bitcoin and Crypto Markets

A more accommodative Fed often supports risk assets, and historically, BTC has performed strongly during periods of monetary easing. Lower interest rates can increase liquidity, reduce the appeal of cash, and enhance demand for assets perceived as hedges against inflation, such as Bitcoin. Analysts suggest that a Fed chair aligned with low-rate policies could create a positive macro backdrop for crypto adoption and institutional interest.

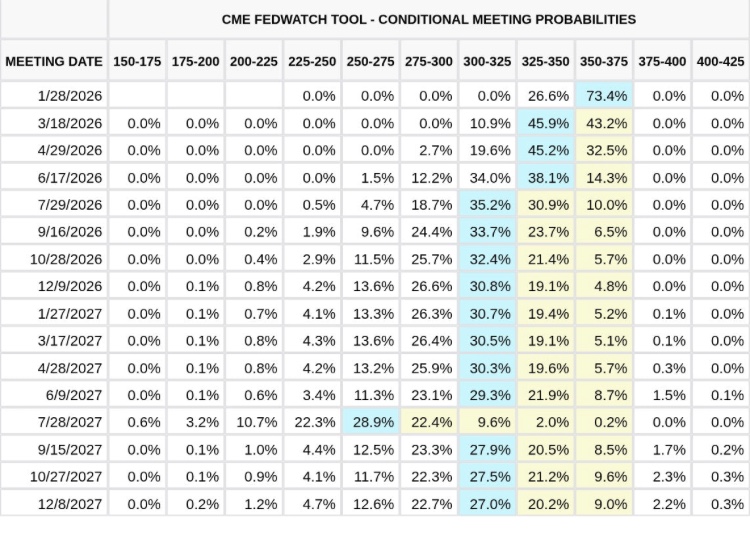

Despite optimism, crypto markets remain volatile amid uncertainty over the final Fed appointment. Tools like the CME FedWatch currently indicate a 73.4% probability that rates will not be cut next month, highlighting the gap between speculation and actual policy shifts. Investors are weighing whether to use this period for early positioning or to wait for official confirmation, as unexpected announcements could trigger sharp market movements.

If the low-rate scenario materializes, Bitcoin could emerge as a primary winner, benefiting both from liquidity inflows and broader institutional adoption. However, analysts caution that markets remain sensitive to macro developments, and careful risk management is essential in this transitional period.

Trump’s Fed leadership signal could mark a turning point for Bitcoin, potentially initiating a new growth phase. Investors are advised to monitor the appointment closely and adjust strategies according to monetary policy developments.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.