Decentralized exchange responds to insider trading concerns as community scrutiny intensifies

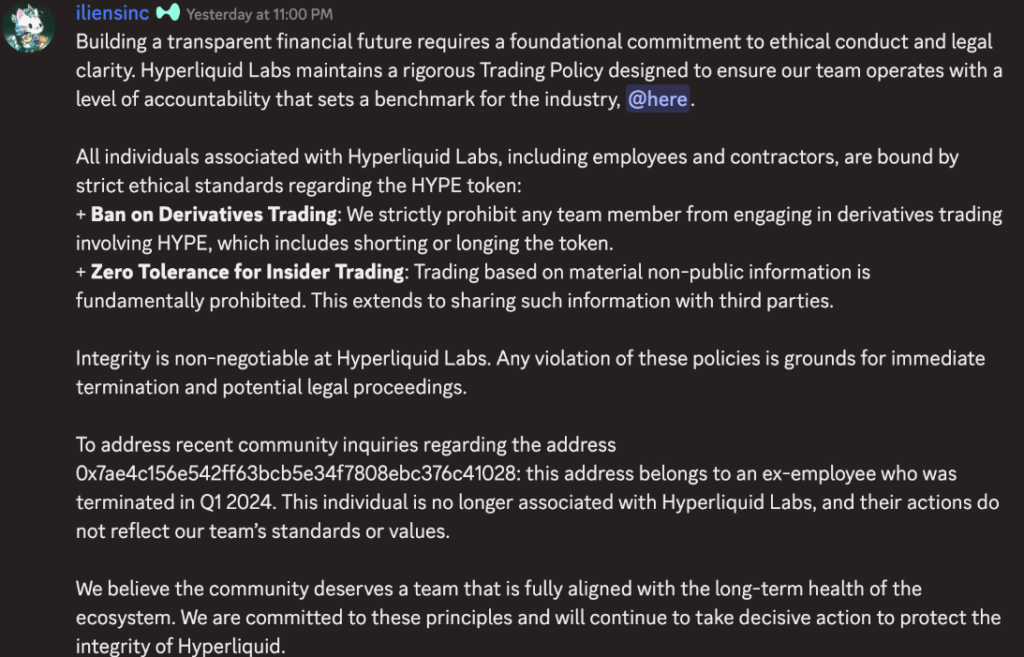

Decentralized perpetuals exchange Hyperliquid has moved to address community concerns surrounding suspicious trading activity involving its native HYPE token. The platform confirmed that a wallet accused of shorting HYPE does not belong to a current team member, but to a former employee who was dismissed earlier in 2024.

Hyperliquid stated that the wallet address publicly scrutinized by users for large HYPE short positions was controlled by an ex-employee terminated in the first quarter of 2024. The exchange emphasized that the individual has had no affiliation with the company since that time and that the activity does not represent internal practices or policies.

The issue gained traction after community members alleged that the address sold approximately 4,000 HYPE tokens in a single day, sparking fears of insider trading. Hyperliquid responded by affirming that the individual acted independently and outside the firm’s governance framework.

Hyperliquid reiterated that all employees and contractors are subject to strict ethical and trading restrictions. These rules explicitly prohibit trading derivatives linked to HYPE, including both long and short positions. The platform also enforces a zero-tolerance policy toward trading based on material non-public information or sharing such data with third parties.

Founded in late 2022, Hyperliquid has emerged as a dominant player in decentralized perpetuals trading. The platform processed more than $650 billion in trading volume in the second quarter of 2025, accounting for roughly 73% of the perp DEX market during that period.

HYPE has seen significant volatility since launch, reaching highs near $60 in 2025 before retreating. Despite a recent decline, the token remains up nearly 300% since inception, underscoring both its rapid growth and heightened scrutiny as adoption expands.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.