Cash allocation rises to $2.19 billion while the company maintains the largest corporate bitcoin holdings

Strategy has temporarily paused its bitcoin acquisition strategy, opting instead to strengthen its cash position. In a recent regulatory filing, the company disclosed that it added $748 million to its USD dividend reserve, signaling a short-term shift in capital allocation while maintaining its long-term bitcoin-focused treasury model.

Strengthening Liquidity Over the Holidays

The latest cash injection brings Strategy’s USD reserve to $2.19 billion, up from the $1.44 billion buffer established earlier this month. The reserve was designed to support future dividend payments and liquidity needs, particularly as the firm continues to operate a hybrid treasury structure combining cash and bitcoin.

During the same period, Strategy did not purchase additional bitcoin, ending a two-week run of aggressive accumulation. Despite the pause, the company’s holdings remain unchanged at 671,268 BTC, reinforcing its position as the largest publicly traded corporate holder of bitcoin.

Recent Bitcoin Accumulation Remains Significant

The halt follows an active buying phase. Over the previous two weeks, Strategy acquired more than 21,000 BTC for approximately $1.9 billion, including a 10,645 BTC purchase valued near $980 million at an average price slightly above $92,000 per coin. The pause appears tactical rather than strategic, as bitcoin remains the firm’s primary treasury asset and capital engine.

Strategy’s stock performance continues to lag, with shares down roughly 43% year to date, compared with bitcoin’s mid-single-digit decline over the same period. Its market cap-to-net asset value ratio sits below parity, reflecting broader pressure across digital asset treasury firms.

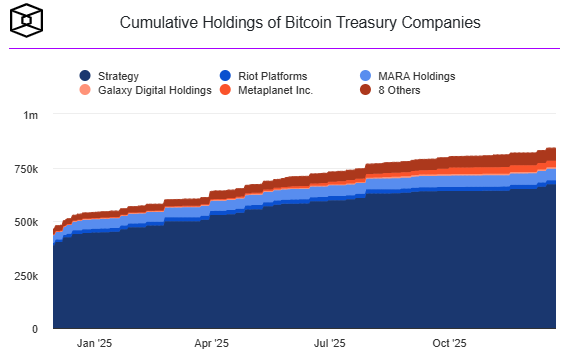

At the same time, the number of public companies holding bitcoin has grown to 192 globally, underscoring sustained institutional interest even as volatility and valuation challenges persist.

While bitcoin accumulation has slowed temporarily, Strategy’s expanded cash reserve highlights a focus on financial flexibility and dividend stability, suggesting preparation for future opportunities rather than a retreat from its long-term bitcoin thesis.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.