Polymarket and Kalshi lead growth as trading activity, partnerships, and mainstream adoption reshape prediction markets.

Prediction markets achieved a record year in 2025, fueled by unprecedented attention, multi-billion-dollar valuations, and growing mainstream adoption. Platforms like Polymarket and Kalshi emerged as dominant players, attracting corporate partnerships, high-profile investments, and increased user engagement. As the U.S. midterm elections approach in 2026, the sector faces a pivotal moment to prove its value as a forecasting tool beyond hype.

Valuations and Investment Surges

Kalshi raised $1 billion at an $11 billion valuation in November, shortly after a $300 million Series D round at $5 billion in October. Polymarket, backed by Intercontinental Exchange (ICE), reached a $9 billion valuation. These figures reflect investor confidence in prediction markets as a source of valuable collective intelligence, even as revenue generation remains limited. Analysts highlight that market data from user activity provides insights far beyond trading profits, offering financial institutions a predictive edge.

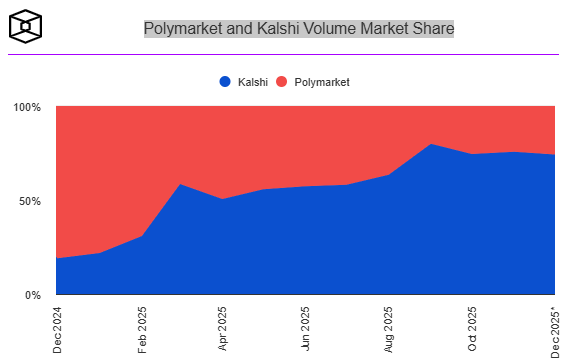

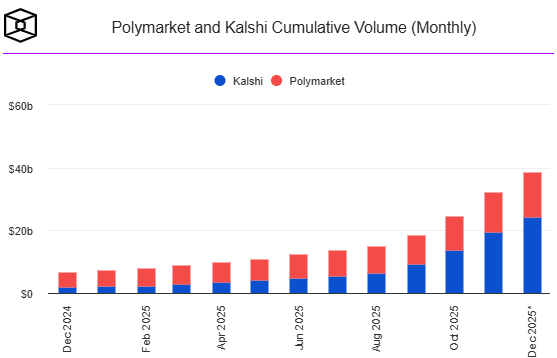

While platforms reported nearly $40 billion in cumulative trading volume, some experts caution that actual usage may be smaller than reported, citing data discrepancies and “double count” errors. Polymarket data is publicly verifiable, whereas Kalshi’s figures are self-reported but regulated under CFTC requirements. Notably, mainstream platforms like Robinhood, Coinbase, and Crypto.com introduced prediction markets, expanding access and driving additional trading volumes, particularly in non-sports categories such as economics, technology, and science.

Mainstream Partnerships and Emerging Trends

Major partnerships with CNBC, CNN, Yahoo Finance, UFC, and the NHL have increased visibility. Sports prop bets and “mention markets” gained attention but also raised concerns over manipulation and regulatory scrutiny. Instances of public figures’ social media activity influencing markets highlight both the opportunities and risks of highly specific event contracts.

With midterm elections and expanding event markets, 2026 could prove transformative for prediction markets. Sustained growth, data reliability, and regulatory navigation will determine whether platforms like Polymarket and Kalshi can move from hype-driven valuations to durable forecasting infrastructure. The sector’s evolution suggests prediction markets are maturing into mainstream tools with practical applications across finance, sports, and public events.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.