Weakening Correlation Suggests Separate Market Cycles for Bitcoin and Precious Metals

Bitcoin does not need gold or silver to slow down before resuming an uptrend, according to market analysts who argue that the assets operate on increasingly independent cycles. Despite recent strength in precious metals and a pullback in crypto markets, analysts say comparisons between Bitcoin and traditional safe havens are often misunderstood.

Bitcoin-to-Gold Ratio and Market Dynamics

The Bitcoin-to-gold ratio currently sits near 19.3, reflecting diverging performance over the past year. Bitcoin spent much of that period in a prolonged consolidation phase, while gold delivered one of its strongest annual rallies in decades. Analysts note that this contrast has amplified the ratio without signaling weakness in Bitcoin’s long-term outlook.

Both Bitcoin and gold are viewed as assets with distinct structural drivers. Gold benefits from macroeconomic uncertainty, currency weakness, and geopolitical stress, while Bitcoin’s narrative remains tied to adoption, network growth, and long-term supply constraints.

Precious Metals Surge as Bitcoin Pulls Back

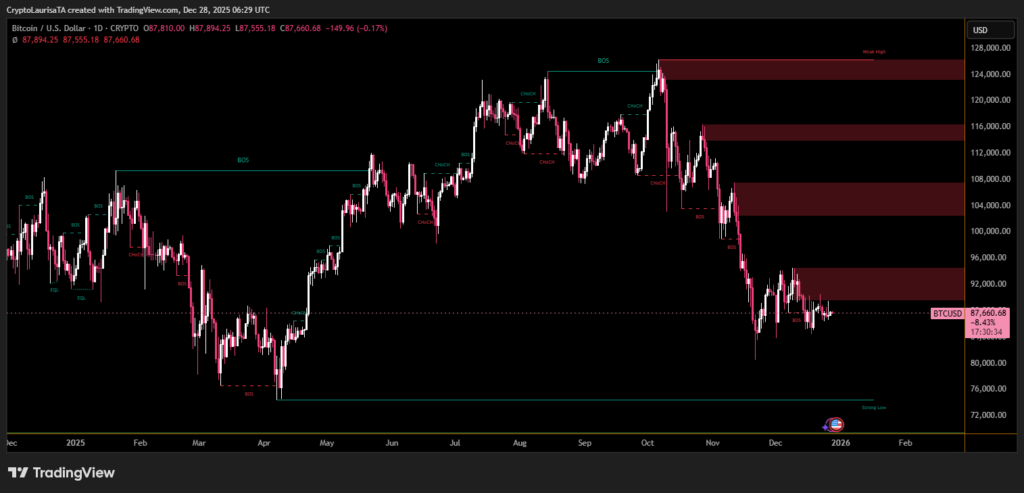

Gold and silver recently reached record highs, supported by expectations of future monetary easing, a softer dollar, and elevated global tensions. At the same time, Bitcoin has declined nearly 30% from its peak of $125,100, trading near $87,700. Over the past 30 days, Bitcoin is down just under 4%.

This divergence has weakened the correlation that previously saw both assets move in tandem between late 2022 and late 2024. Year to date, gold is up roughly 60%, while Bitcoin is down about 7%.

Market sentiment highlights the split. Gold indicators currently reflect strong optimism, while crypto sentiment remains deeply cautious. Despite this, several industry leaders expect Bitcoin’s trend to reverse in 2026, with some projecting a multi-year expansion phase driven by long-term adoption rather than movements in precious metals.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.