Bitcoin Acts as a Market Check on Inflation, Deficits, and Fiscal Discipline

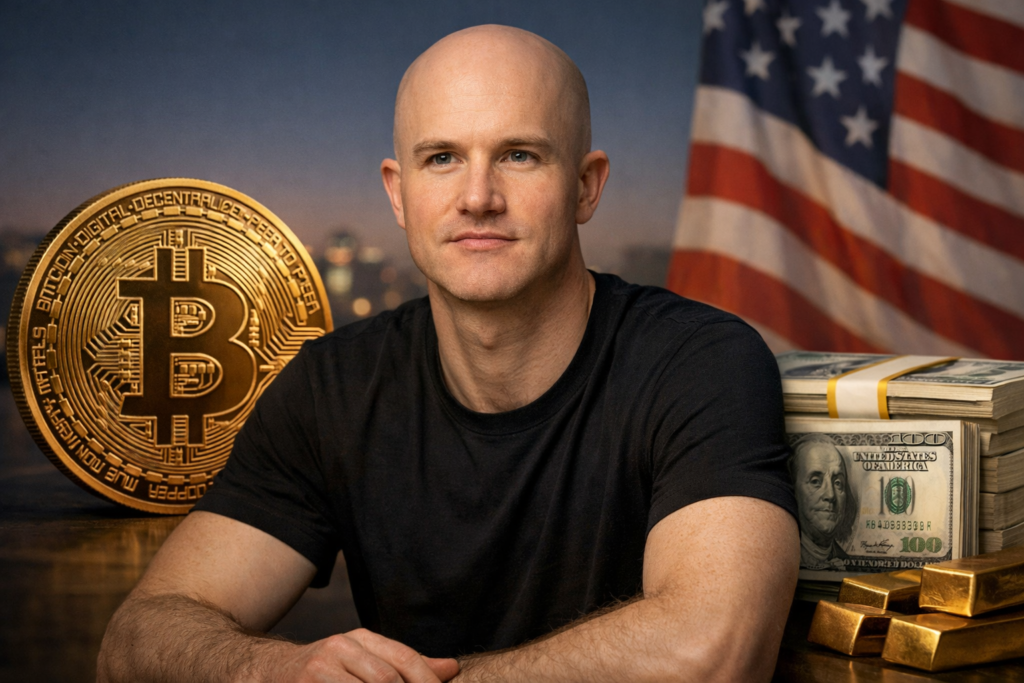

Bitcoin may be strengthening the US dollar’s reserve currency status in an unexpected way, according to the chief executive of a major US crypto exchange. Rather than replacing the dollar, Bitcoin is increasingly viewed as a competitive pressure mechanism that discourages excessive inflation and unchecked government spending.

The argument centers on Bitcoin serving as a market-driven alternative during periods of economic uncertainty. When inflation or deficit spending accelerates beyond sustainable levels, capital can move into Bitcoin, sending a clear signal to policymakers. This dynamic, proponents argue, creates an incentive for authorities to maintain price stability and economic credibility.

It is widely accepted that moderate inflation of 2–3% can coexist with healthy economic growth. However, when inflation outpaces real economic expansion, confidence in a currency can erode, potentially threatening its role as a global reserve. Bitcoin’s presence provides a visible escape valve, indirectly reinforcing restraint within the existing monetary system.

The discussion comes as US national debt approaches $38 trillion, growing by billions of dollars daily. Against this backdrop, Bitcoin and gold have increasingly been framed as hedges against currency debasement. While Bitcoin has experienced recent price volatility, gold has continued setting new highs, reflecting persistent investor concern around fiat stability.

Alongside Bitcoin, US dollar–pegged stablecoins are expanding global dollar access. With the stablecoin market exceeding $300 billion and projections reaching $2 trillion by 2028, digital dollars may further cement US monetary influence worldwide.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.