Bitcoin and Ethereum products lead capital exits while XRP and Solana attract selective inflows

Global crypto exchange-traded products (ETPs) recorded $446 million in net weekly outflows, extending a bearish trend across digital asset investment vehicles. Despite broad-based selling pressure, XRP-focused funds posted notable inflows, standing out as one of the few areas of strength in an otherwise weak market, according to the latest fund flow data.

Bitcoin and Ethereum Drive Market Outflows

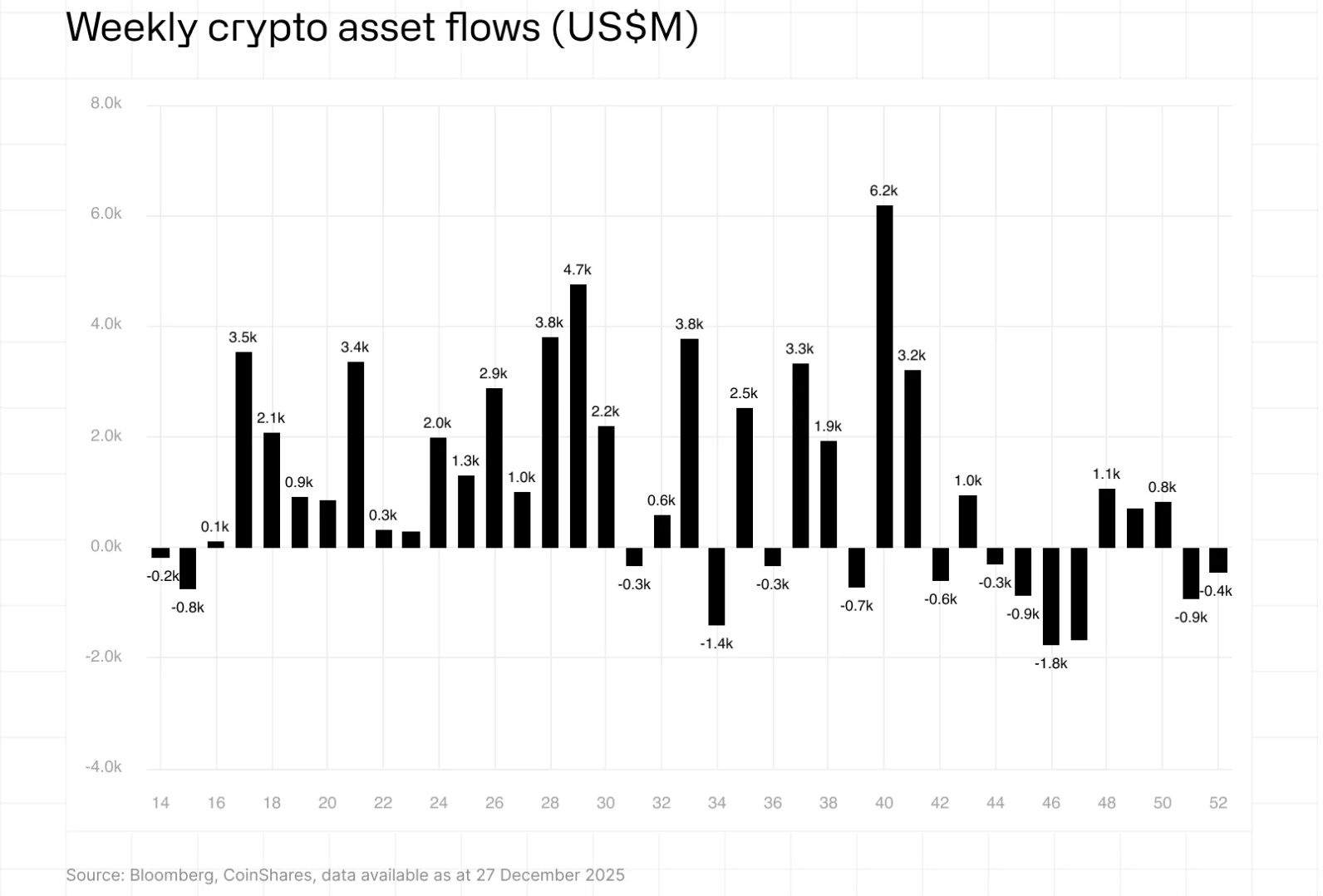

The majority of last week’s withdrawals were driven by Bitcoin and Ethereum investment products. Bitcoin ETPs alone saw nearly $443 million in outflows, while Ethereum-based funds lost approximately $59 million. Since the market shock on October 10, cumulative crypto ETP outflows have now reached $3.2 billion, reflecting persistent caution among institutional investors.

Investor sentiment has yet to fully recover, as recent weeks have alternated between brief inflows and sharp reversals. Although year-to-date inflows remain relatively stable compared with last year, total assets under management have increased by only about 10%, suggesting muted returns once capital movements are accounted for.

XRP Funds Attract Capital Amid Weak Market

In contrast to broader trends, XRP investment products recorded around $70 million in inflows. A newly launched XRP exchange-traded fund attracted $28.6 million, indicating selective confidence in XRP-linked exposure. Solana-focused funds also posted modest inflows of $7.5 million, though the majority of alternative assets continued to see limited demand.

XRP’s relative resilience highlights diverging investor strategies, with some participants rotating into assets perceived as undervalued or less correlated with Bitcoin and Ethereum price action.

The United States led global outflows with $460 million, reflecting heavy selling in large US-listed products. Switzerland followed with $14 million in outflows. However, Germany emerged as a notable exception, posting $35.7 million in weekly inflows and $248 million in total recent inflows, suggesting investors there are using price weakness as an accumulation opportunity.

While overall crypto fund flows remain under pressure, selective inflows into XRP and regional accumulation trends indicate that investors are becoming more targeted rather than exiting the market entirely.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.