Spot Bitcoin ETFs Face Largest Withdrawals Since Launch

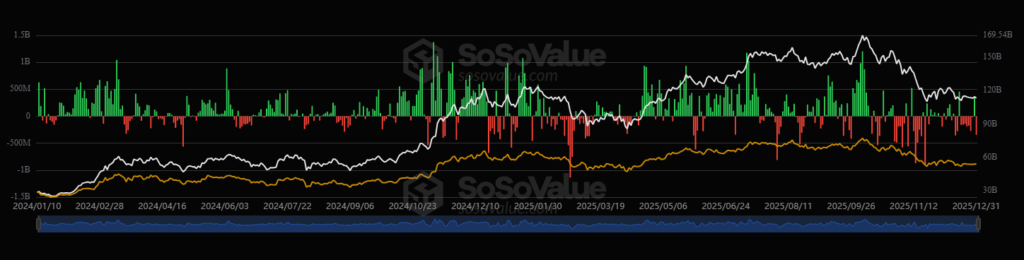

U.S.-listed spot Bitcoin ETFs experienced their most challenging two-month period on record, with net outflows totaling $4.57 billion across November and December 2025. This coincided with a 20% drop in Bitcoin prices, highlighting a notable decline in institutional interest.

The 11 active spot ETFs collectively lost $3.48 billion in November followed by $1.09 billion in December, marking the largest redemption period since January 2024. Previously, the worst two-month stretch occurred in February-March, with $4.32 billion withdrawn.

Similarly, Ether ETFs saw significant withdrawals, with investors pulling over $2 billion during the same period. These trends reflect reduced appetite among institutional investors, though some market analysts suggest the sell-off is part of a market equilibrium rather than panic. Stronger balance sheets are absorbing supply while weaker hands exit before the year-end.

In contrast, not all crypto ETFs suffered. XRP ETFs attracted more than $1 billion in inflows, while Solana (SOL) ETFs collected over $500 million, indicating selective interest in alternative cryptocurrencies.

The ETF outflows and market liquidations underscore the volatility of crypto investment products, even as some investors shift focus to other assets. Analysts anticipate liquidity may return in early 2026, potentially stabilizing ETF performance.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.