The Ethereum network is showing a notable shift in staking behavior as the validator exit queue has fallen to zero, signaling a sharp decline in near-term selling pressure. At the same time, demand for staking ETH has surged, reinforcing Ethereum’s position as a long-term yield-generating asset.

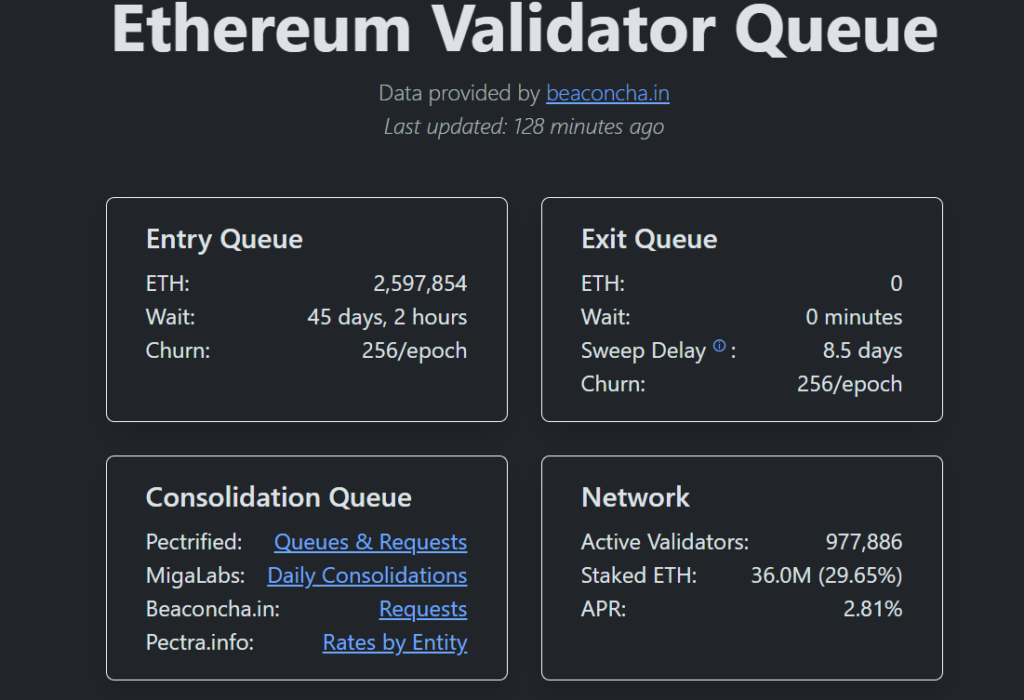

The validator exit queue has declined from a peak of 2.67 million ETH in September 2025 to zero ETH today, while the entry queue has expanded rapidly. Over the past month alone, more than 2.6 million ETH has entered the staking queue the highest level recorded since mid-2023.

New validators now face waiting periods of up to 45 days to activate, compared with exit requests that are processed within minutes. This imbalance reflects growing confidence among holders who are choosing to lock ETH for yield rather than withdraw it for liquidity.

Institutional participation has played a role in this trend, supported by staking yields near 2.8% annually. Large-scale staking activity has contributed to the tightening of available ETH supply.

On-chain data shows that more than 46.5% of Ethereum’s total supply is now held in proof-of-stake deposit contracts, equivalent to roughly 77.85 million ETH. Total staked ETH stands at approximately 36.1 million, or about 29% of total supply.While ETH remains below its previous all-time high, the combination of reduced exit pressure and sustained staking inflows suggests a structurally stronger market outlook for the months ahead.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.