U.S. spot bitcoin exchange-traded funds (ETFs) recorded $1.42 billion in weekly net inflows last week, marking their largest weekly total since early October and signaling renewed institutional interest in the cryptocurrency. BlackRock’s IBIT led the inflows, contributing $1.03 billion for the week ended January 16.

The surge in ETF inflows coincided with Bitcoin’s short-term price rally to around $97,000, up from approximately $90,500 at the start of the week. Despite the gains, BTC pulled back to about $92,618 late Sunday amid headlines of U.S.-EU trade tensions over Greenland, reflecting ongoing market volatility. Analysts note that inflows point to continued accumulation by institutional investors and potential supply tightening that could support future recovery.

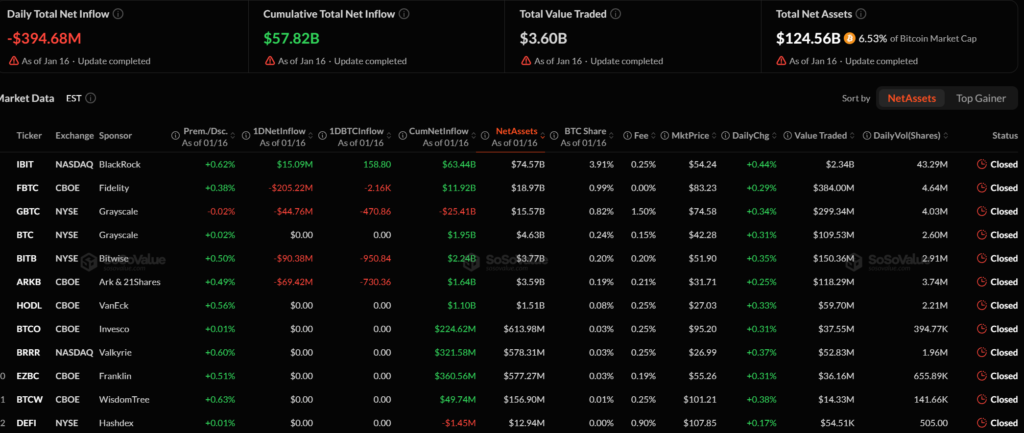

According to SoSoValue data;

However, derivatives-driven market dynamics have added volatility. In the past 24 hours, the crypto market saw roughly $824 million in liquidations, primarily from over-leveraged long positions. This highlights that while structural support remains strong, price movements continue to be influenced by liquidity constraints and forced liquidations.

Spot Ethereum ETFs also saw strong inflows, totaling $479 million, their highest weekly amount since early October. The data underscores growing institutional demand for digital assets and suggests that ETF-based exposure continues to play a key role in shaping market participation and sentiment.

Overall, the combination of strong ETF inflows and derivative-driven volatility indicates that while long-term confidence in crypto remains, short-term price swings are likely to persist.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.