Bitcoin’s market structure is showing early but notable improvement, according to recent on-chain and spot market data. While price action remains under pressure below the $93,000 level, internal indicators suggest that selling momentum is easing and the market may be entering a stabilization phase.

Bitcoin Spot Volume Rises as Sell Pressure Declines

Recent data highlights a modest increase in Bitcoin spot trading volume, paired with a clear reduction in sell-side dominance. The balance between buyers and sellers has shifted, indicating that aggressive selling is cooling. However, spot demand remains fragile, reflecting cautious investor sentiment amid broader macroeconomic uncertainty.

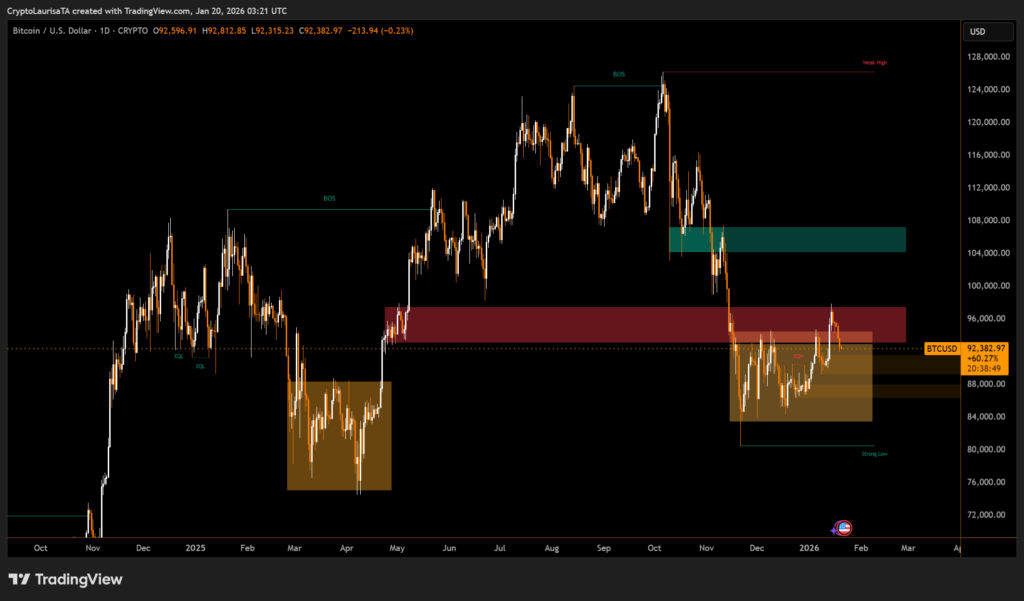

Bitcoin pulled back nearly 3% from recent highs near $95,450, trading close to $92,500, as markets reacted to renewed concerns around global trade tensions. Despite the short-term decline, Bitcoin is still up approximately 6% year-to-date, reinforcing its resilience.

Bitcoin Consolidation Phase Continues

Analysts describe the current environment as a consolidation phase, where internal conditions are improving even as price struggles to break higher. Defensive positioning persists, but buy-side dynamics are gradually strengthening, supported by renewed institutional accumulation during market pullbacks.

Bitcoin network growth and liquidity have declined to levels last observed in 2022, a period that preceded a major market recovery. Historically, a rebound in these metrics has acted as a foundation for sustained rallies, suggesting the current setup may support a more constructive market structure over time.

Analysts at Swissblock said that;

Overall, while volatility remains, Bitcoin’s internal health is quietly improving, laying groundwork for longer-term stability.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.