Pendle, a decentralized finance yield protocol, is rolling out a major update to its governance structure as it seeks to address low adoption and usability challenges tied to its existing token model. The platform will gradually phase out vePENDLE and introduce sPENDLE, a new liquid staking and governance token designed to offer greater flexibility for users.

The transition begins this month, with sPENDLE staking set to go live immediately, while new vePENDLE locks will be paused. A snapshot of current vePENDLE balances will support a smooth migration to the updated system. Once complete, the new governance framework will fully replace the previous model.

In an announcement via X on Monday;

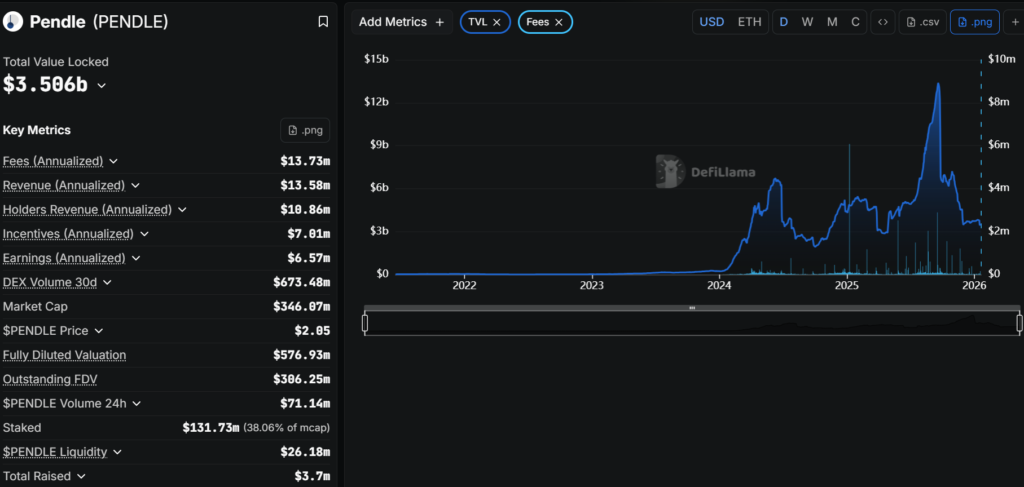

Pendle explained that although the protocol has seen strong growth with nearly $3.5 billion in total value locked, ranking it among the top DeFi platforms the vePENDLE structure created significant barriers to participation. Long lock-up periods, non-transferability, and complex weekly voting requirements limited engagement to a small group of advanced users.

The new sPENDLE token introduces a 14-day withdrawal period, with an option for instant exit at a fee, offering far more flexibility. Unlike its predecessor, sPENDLE is interoperable across DeFi ecosystems, enabling use cases such as restaking and broader yield strategies.

Governance is also being simplified. Instead of frequent voting, holders will only need to participate in critical protocol proposals to remain eligible for rewards. When no proposals are active, eligibility continues automatically.

To further support token value, Pendle plans to allocate up to 80% of protocol revenue toward token buybacks, redistributing them as governance incentives. This shift aims to create a more inclusive, efficient, and sustainable governance system without changing the core mission of the protocol.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.