World Liberty Financial (WLFI) is facing growing criticism after a governance vote approved a USD1 growth proposal, with on-chain data revealing that a small group of wallets held decisive control over the outcome. The vote has raised concerns about fairness, transparency, and the role of insider influence in protocol governance.

Blockchain records show that the top nine wallets controlled nearly 60% of total voting power, effectively determining the result of the proposal. The largest single wallet alone accounted for 18.7% of the vote, according to the snapshot data. These wallets have been flagged by independent researchers as being linked to the project team or strategic partners.

At the same time, a large portion of WLFI holders were unable to participate because their tokens remain locked, preventing them from voting on governance matters that directly affect their holdings. Critics argue this imbalance undermines the principle of decentralized decision-making.

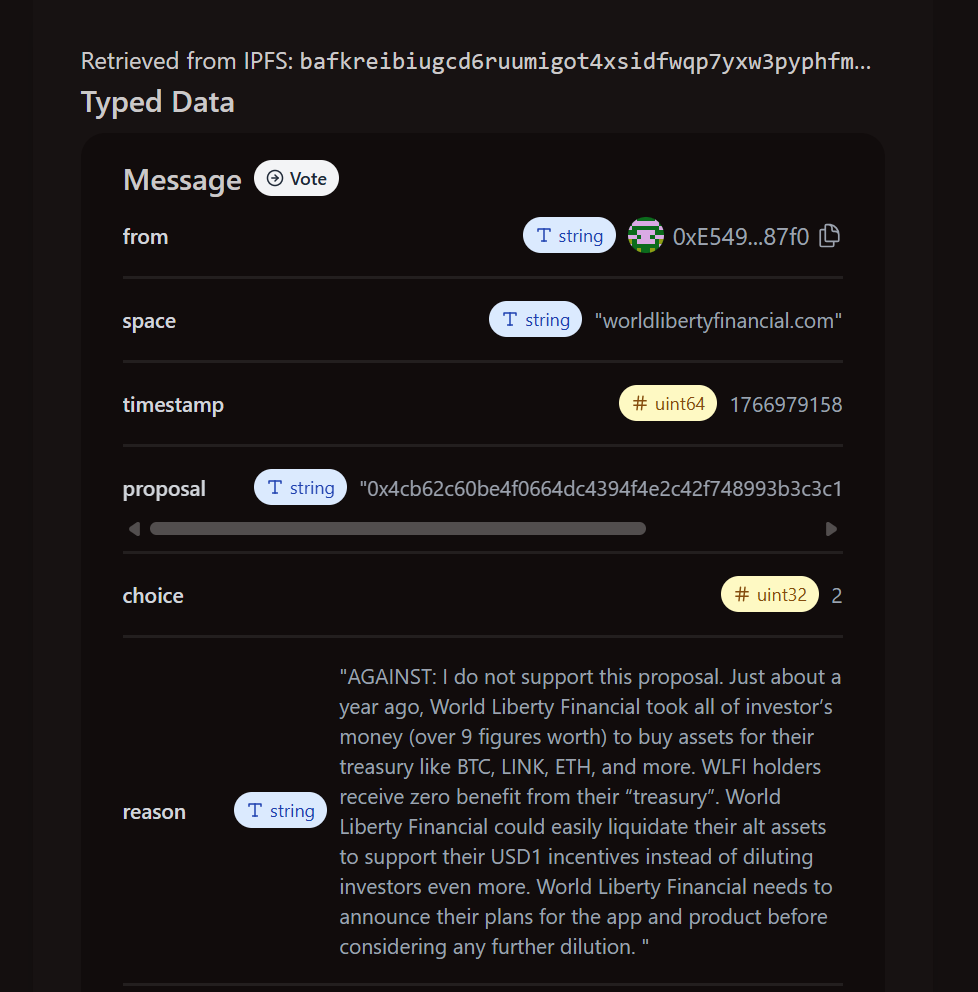

The USD1 growth proposal has also intensified debate over WLFI tokenholder benefits. Community members highlighted that WLFI holders are not entitled to protocol revenue, while most net income is allocated to affiliated entities. Some investors warned that expanding USD1 incentives could further dilute holders without offering direct returns.

One tokenholder who voted against the proposal said the measure would further dilute investors without offering any clear benefit in return;

Despite the backlash, World Liberty Financial recently moved to strengthen its regulatory footprint by applying for a US national trust banking charter, aiming to centralize issuance and custody of USD1. While this could boost institutional adoption, critics say governance and incentive alignment issues remain unresolved.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.