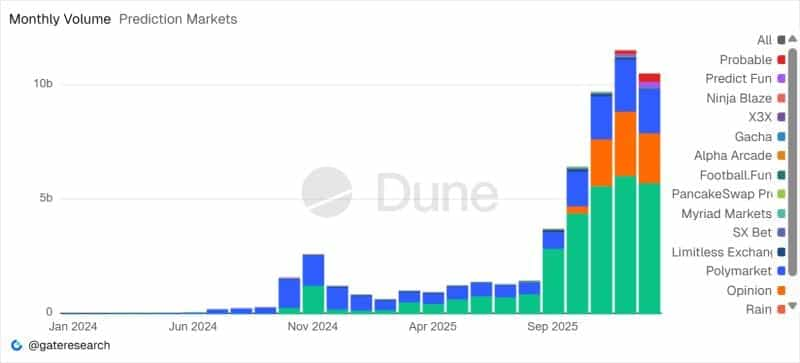

Prediction markets are experiencing a sharp acceleration in activity after recording more than $814 million in trading volume in a single day, putting the sector on track to set a new monthly volume record. The surge reflects growing trader engagement, expanding platform competition, and rising interest from both crypto-native users and traditional finance.

Total trading volume across prediction market platforms has already reached approximately $10.5 billion in January, with more than a third of the month still remaining. December’s previous record of $11.5 billion now appears within reach, extending the sector’s streak to six consecutive months of rising activity.

This momentum highlights how prediction markets are transitioning from niche products into a more meaningful segment of digital asset trading.

Established platforms continue to lead, with one major exchange processing over $535 million in daily volume, while another posted around $127 million on the same day. At the same time, newer platforms are gaining traction, capturing nearly $84 million in daily volume and steadily eroding market share from incumbents.

Rising volumes have translated directly into higher revenue. Weekly platform fees surpassed $2.7 million, the highest level on record. More than half of those fees were generated by a fast-growing platform, while short-duration contracts accounted for a significant share of revenue elsewhere.

Notably, prediction markets’ share of overall spot crypto trading has now exceeded 1% for the first time, marking a key milestone.

With new entrants, innovative market structures, and increasing attention from large financial institutions, prediction markets appear to be entering a new growth phase, even as liquidity and regulatory clarity remain ongoing challenges.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.